Summary of Contents for Calculated Industries 3416

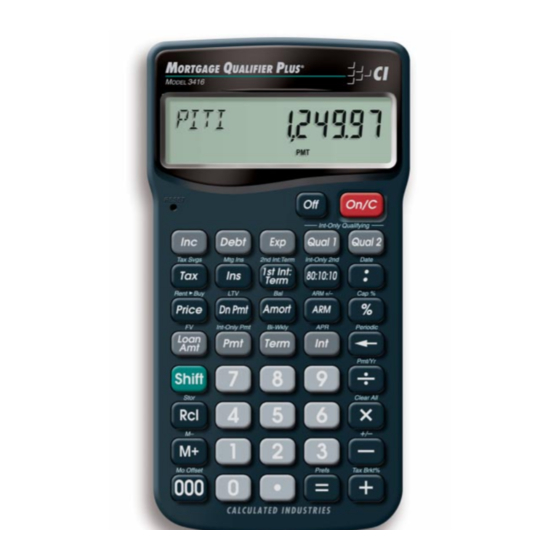

- Page 1 ORTGAGE UALIFIER ® Residential Mortgage Finance Calculator Model 3416 ’ UIDE...

- Page 2 With the push of a few buttons, it will pre-qualify prospective buyers instantly and solve hundreds of mortgage loan problems with ease! It’s the most com- plete and easy-to-use real estate finance calculator on the market! New Features! •...

-

Page 3: Table Of Contents

Percentage Calculations ...13 Figuring Straight % Commission ...13 Reduction in Listing Price (Discount %) ...14 Simple, One-Year Home Appreciation (Add-on %)...14 Date Examples...15 CALCULATOR SETTINGS...16 Decimal Place Selection ...16 Preference Settings ...17 MEMORY ...19 Accumulative Memory...19 Memory Storage Keys (M0-M6)...20 Additional Memory Storage Keys ...21... - Page 4 Finding Loan Amount Based on Sales Price and Down Payment...28 Taxes and Insurance...29 Setting Tax and Insurance % Rates...30 Recalling Tax and Insurance % Rates ...30 Setting Tax and Insurance $ ...30 Calculating Tax and Insurance % or $ ...31 PITI Payment (Tax and Insurance Entered as %) ...32 Total Payment (Including Expenses) and Interest-Only Payment...32...

- Page 5 Finding Qualifying Loan Amount and Sales Price (Simple Example Excluding Tax/Insurance)...54 Qualifying Loan Amount and Sales Price (Complete Example Including Down Payment, Tax/Insurance, Monthly Association Dues) ...55 “Restricted” Qualifying ...56 “Unrestricted” Qualifying ...56 Qualifying Comparison (Comparing 2 Different Loans or Ratios at Once) ...57 Qualifying Loan Amount (Interest-Only Loan)...58 Finding Income Required and Allowable Monthly Debt ...59...

-

Page 6: Getting Started

Memory functions. Works with other keys to set or activate second functions (it will perform the function printed above the key on the calculator's face). Also used to set the number of displayed decimal places (see section on Decimal Place Selection). -

Page 7: Mortgage Loan (Tvm) Keys

s – Change Sign (+/–) — Changes the sign of the dis- played value from positive to negative or vice versa. Clear All — Clears all entered values and returns any stored values to their default settings. Use this only with caution, as it will reset ratios, Periods per Year, etc. - Page 8 ˆ Interest — Enters or solves for the annual interest rate. Second press gives the periodic rate. Note: Stored permanently, until you change it or perform a Clear All ( s x ). Future Value (FV) — Enters or solves for the future value of a financial problem.

- Page 9 s ÷ Payments per Year (Pmt/Yr) — Used to set the number of payment periods per year. Default value is 12, for monthly. Note: You can store the number of payments/year permanently or semi-permanently. See Preference Settings). Amortization (Amort) — Finds total interest, princi- pal, remaining balance, remaining term and estimat- ed mortgage interest tax deduction.

- Page 10 Adjustable Rate Mortgage — Calculates the pay- ment and re-amortizes a fully or partially amortized Adjustable Rate Mortgage based on the inputs of both an Interest Adjustment and a Term Adjustment, which are entered using the Colon : key (Interest Adjustment : Term Adjustment).

-

Page 11: Tax, Insurance And Expense Keys

Tax, Insurance and Expense Keys In addition to Qualifying, the following keys are also involved in PITI or total payment calculations (e.g., they are added to the monthly payment): Property Tax — Used for calculating PITI and Total payment, and Qualifying. Stores estimated annual property tax in either percent or dollar amount. -

Page 12: Tax Savings Function

Note: Tax and Insurance entered as dollar amounts will remain fixed, even if sales price or loan amount is changed. However, if entered as a percentage of sales price or loan amount, these items will automatically be re-calculated if sales price or loan amount is changed. -

Page 13: Qualifying Keys

Qualifying Keys (Qualify Based on 28%-36%) — A multi-function key which, based on entered variables, performs the following pre-qualifying functions: 1) Stores income and debt ratios for loan quali- fying. Ratios are entered using the Colon : key (Income Ratio : Debt Ratio). For example, income and debt ratios of 28% and 36%, respectively, are entered and permanently stored as follows: 2 8 : 3 6 q. - Page 14 In other words, whichever ratio will give the buyer the highest qualifying loan amount. For this Unrestricted loan amount, the calculator will display the letters “UNR” (for unrestricted) in the display and the word “INC” or “DEBT” to indi- cate what ratio side this loan amount was based from (i.e.,...

- Page 15 (Cont’d) 3) Calculates the annual income (“Stated Income”) required and allowable monthly debt for a desired loan amount or sales price based on the stored income and debt qualifying ratios and the entered: • Term • Interest • Price (down payment) or Loan Amount 4) Also finds buyer's actual income and debt ratios given both buyer and property data.

-

Page 16: 1St And 2Nd Trust Deeds (Combo Loan) Keys

1st and 2nd Trust Deeds (Combo Loan) Keys The Combo Loan keys show the savings of obtaining a 1st and 2nd trust deed (TD) loan over a single, fixed-rate loan where mortgage insurance, or private mortgage insurance (PMI), is required. This routine requires a fixed-rate loan to be entered using the stan- dard l, p, ˆ... - Page 17 (Cont’d) ** and s * (Int-Only 2nd) Key Output: For a comparison of a fixed-rate combo loan versus a fixed-rate loan with required mortgage insurance, each key press (once all other loan values are entered, including 1st:2nd Interest:Term) will calculate: Press Calculation 1st TD Interest:Term —...

-

Page 18: Basic Arithmetic Examples

BASIC ARITHMETIC EXAMPLES Arithmetic This calculator uses standard chaining logic, which simply means that you enter your first value, the operator (+, –, x, ÷), the sec- ond value and then the equals sign (=). A. 3 + 2 = B. -

Page 19: Reduction In Listing Price (Discount %)

5%. Calculate both the amount of reduction in dollars and the new, lowered listing price. STEPS Clear calculator Enter sales price Subtract 5% Find new listing price Simple, One-Year Home Appreciation (Add-on %) Properties in your area have been going up in value about 6% per year. -

Page 20: Date Examples

For exam- ple, if a 45-day escrow begins April 26, 2004, what is the closing date and day? STEPS Clear calculator Enter month Enter day Enter year Add 45 days... -

Page 21: Calculator Settings

CALCULATOR SETTINGS Decimal Place Selection With the s key, you have the option of selecting the number of decimal places you’d like to display. The values are rounded using conventional 5/4 rounding. You can do this prior to finding an answer or afterwards. -

Page 22: Preference Settings

Preference Settings Your calculator has a Preference Mode, which allows you to program the calculator to various settings. For example, it lets you store cer- tain values permanently, display certain values, or show values in a specific order. To access the Preference Mode, press s, then =, then keep pressing = to toggle through the settings listed below. - Page 23 (Cont’d) After s , Keep Pressing Display Mortgage Insurance (MI) - Clr-Clr M Ins — - Clr OFF M Ins — - HOLD Pct. M Ins — - HOLD ALL M Ins — Amortization/Single Entries - AMRT Ent-Ent — - AMRT 1-Ent — Display Qualifying Ratios - Q-R PRESS 1 —...

-

Page 24: Memory

Accumulative Memory Whenever the µ key is pressed, the displayed value will be added to cumulative memory. This value will remain in Memory until cleared or when the calculator is turned off. Other Memory functions: FUNCTION Recall total in Memory... -

Page 25: Memory Storage Keys (M0-M6)

Storage Registers — [M0] through [M6] — that can be used to permanently store single , non- cumulative values. These values will be held when your calculator is turned off, and will only clear when a “Clear All” is performed (via s x). -

Page 26: Additional Memory Storage Keys

Additional Memory Storage Keys (M10-M19) In addition to M0-M6 (as described previously), your calculator has ten additional independent Storage Registers — M10 through M19 — that can also be used to permanently store single, non-cumulative values. To access these storage registers, use the following key- strokes: s ®... -

Page 27: Examples

4. Entered values for Term and Interest are permanently stored (they do not clear when the calculator is turned off). 5. The calculator’s default setting is 12 payments per year, for monthly loans. 6. It is good practice to press o twice after completing a finan- cial problem to ensure that you have cleared the previous l and p registers. -

Page 28: Finding The Monthly Mortgage (P&I) Payment

Finding the Monthly Mortgage (P&I) Payment Find the monthly P&I (principal and interest) payment on a 30-year, fixed-rate mortgage of $265,000 at 6.75% annual interest. STEPS Clear calculator Enter loan amount Enter term Enter interest Find monthly P&I payment p *Note: Use the ) key to save keystrokes. -

Page 29: Finding The Interest Rate

Finding the Interest Rate Find the interest rate on a mortgage where the loan amount is $98,500, the term is 30 years, and the payment is $1,150 a month. STEPS Clear calculator Enter loan amount Enter term Enter monthly payment... -

Page 30: Paying Off A Mortgage Early (Making Larger Payments)

How long does it take to pay off a 30-year, fixed-rate mortgage of $150,000 at 8.5% interest if you add an extra $200 to the mortgage payment each month? STEPS Clear calculator Enter loan amount Enter interest Enter term Find monthly P&I payment p... -

Page 31: Future Value

You purchased a home for $350,000 and want to know its value in 3 years, figuring an inflation or appreciation rate of 6%. (Set periods to one per year.) STEPS Clear calculator Set to 1 payment/year Enter present value* Enter term in years... -

Page 32: Non-Monthly Loans

Most residential real estate loans are based on a monthly payment schedule. However, if you have a non-monthly loan, you must change the number of payments per year using a two-key sequence: s ÷. For example, here's how to set your calculator to four pay- ments per year. STEPS... -

Page 33: Sales Price/Down Payment

Sales Price/Down Payment One of the unique features of this calculator is its ability to work with not only Loan Amount, but with Sales Price and Down Payment. You can enter two values to find the third (e.g., enter Price and Down Payment to find Loan Amount). -

Page 34: Taxes And Insurance

(PITI plus expenses). By default, the Property Tax and Insurance values are cleared when the calculator is shut off, while the Mortgage Insurance value clears when you press o twice. However, you may use the Preference... -

Page 35: Setting Tax And Insurance % Rates

Recall insurance rate Recall mortgage insurance rate Note: To change these values, simply enter new ones. Or, turn the calculator off then on, and the values will be cleared, unless they are programmed to hold under Preference Settings (see page 20). -

Page 36: Calculating Tax And Insurance % Or

0.50%. Then enter a sales price of $250,000, 10% down, a term of 30 years and an interest rate of 8%. Calculate the loan, payments, and annual tax and insurance dollar amounts, or premiums: STEPS Clear calculator Enter property tax rate Enter insurance rate Enter mortgage insurance rate... -

Page 37: Piti Payment (Tax And Insurance Entered As %)

$325,000 and the down payment is 5%. Annual prop- erty taxes are estimated at 1.3%, annual property insurance at 0.25%, and annual mortgage insurance at 0.45%. STEPS Clear calculator Enter term in years Enter annual interest Enter sales price... -

Page 38: Estimated Income Tax Savings And "After-Tax" Payment

Enter tax bracket Find annual income tax savings Find monthly tax savings Find “after-tax” payment — DO NOT CLEAR CALCULATOR — If the above loan starts in July, find the “after-tax” payment. STEPS Set Mo. 1 Offset to July Enter tax bracket... -

Page 39: Rent Vs. Buy

7.5% on a 30-term Fixed-Rate Mortgage, and your client can afford to put 10% down. You estimate local taxes at 1.25% and property insurance at 0.35%. Your client is in the 21% tax bracket. STEPS Clear calculator Enter interest rate Enter term Enter down payment... -

Page 40: Adjustable Rate Mortgages

4. To calculate a “decreasing ARM,” enter the two ARM parame- ters, but press the s key before pressing A. 5. The calculator includes a “lifetime cap” (i.e., the maximum amount the interest rate may increase over the life of a loan). -

Page 41: Arm Payment - Worst-Case Scenario

“worst-case” adjusted payments if this ARM loan increases 0.5% at the end of each year. Then, find the remaining loan balance, current interest rate and term. STEPS Clear calculator Enter loan amount Enter term in years Enter annual interest Find initial monthly payment... -

Page 42: Arm Payment - Using Lifetime Cap

Using the previous mortgage, add a lifetime cap of 4% and find the adjusted payments through year ten. You will need to re-enter the loan amount, term and interest. STEPS Clear calculator Enter loan amount Enter term in years Enter annual interest... -

Page 43: Decreasing Arm Payment

5% interest, and then find the second and third years' adjust- ed payments if the loan's interest rate decreases 1% at the end of each year. STEPS Clear calculator Enter loan amount Enter term in years Enter annual interest... -

Page 44: Amortization And Remaining Balance

5. In some cases, it is the practice to include a final, regular P&I payment with the "balloon payment." This calculator will not in- clude that in the internal calculation of remaining balance; it will only display the actual principal balance remaining. -

Page 45: Total Principal And Interest For A 30-Year Loan

(after remaining balance is displayed), if a tax bracket is also entered via s + (Tax Brkt%) . Note: If a tax bracket % is not entered, the calculator will use the default of 28%, displayed upon ® + . -

Page 46: Amortization List For Individual Year(S) - Using "Next" Feature

$90,000 loan at 8% interest during the first year? The second year? Third year, etc.? First, find monthly payment to “set-up” this loan. The calculator will automatically advance to the next year upon sub- sequent presses of a. Note: The mortgage interest tax deduction is based on the default tax bracket of 28% unless you have changed it via s + . -

Page 47: Amortization List For Individual Year(S) - Using Month Offset

“set-up” this loan.) Note: The mortgage interest tax deduction is based on the default tax bracket of 28% unless you have changed it via s + . Calculator will automatically advance to the next year upon subsequent presses of a . -

Page 48: Amortization List For Individual Payment(S)

Payment #1 a Display Payment #2 (etc.—sequence repeats for each payment) — DO NOT CLEAR CALCULATOR — For the same loan, find the amount of principal and interest paid in the 36th payment. Also, find the total payment, remaining balance and remaining term. -

Page 49: Amortization List For A Range Of Payments Or Years

For a $225,000, 30-year loan at 7.4% interest, find out how much interest and principal you'll pay in payments 1-9, and then for years 1-10. STEPS Clear calculator Enter loan amount Enter interest Enter term Find monthly P&I payment p... -

Page 50: Apr And Total Finance Charges

(that is, enter three known variables and solve for the fourth) and (2) combine points and fees and press s ˆ (APR) to solve APR. If you continue to press ˆ, the calculator will also display the total finance charges, and a third press will dis- play total finance charges plus principal (total cost of loan). -

Page 51: Prepaid/Odd-Days Interest And Apr

— DO NOT CLEAR CALCULATOR — Now, without clearing the calculator, add the prepaid interest to the loan's points and fees if they are equal to 1.5% and $500, respec- tively. Then find the Annual Percentage Rate (APR), based on these closing costs. -

Page 52: Balloon Payment/Remaining Balance Needed To Pay Off A Loan

Find balloon/remaining balance after 10 years Bi-Weekly Loans Your calculator includes a Bi-Weekly loan function (s T) that allows you to convert established, fully amortized monthly loans into Bi-Weeklies (in which one-half the monthly payment is made every two weeks). Because you make two extra half-payments per year (i.e., 26 Bi-Weekly payments is like making 13 payments/year),... -

Page 53: Bi-Weekly Term Reduction And Payment

**Note: Return to monthly payment mode by pressing o twice. Trust Deeds and Discounted Notes Your calculator easily handles trust deed purchase price and yield problems. Two things to remember are: (1) when entering or solving for “yield” or “rate of return,” use the ˆ key, and (2) when entering or solving for “purchase price”... -

Page 54: Purchase Price Of A Note - Fully Amortized

Enter term Enter payment amount Find purchase price — DO NOT CLEAR CALCULATOR — What if you want a 20% yield? Leave all of the above data and re- enter the 20% interest over the old rate, then re-calculate the loan amount. -

Page 55: Finding The Value And Discount Of A Trust Deed

Enter your desired yield Compute value of mortgage l Subtract from Memory Compute discount (recall Memory) Clear Memory* *Note: Pressing ® ® or turning the calculator O will clear the value stored in Memory. 50 — M ORTGAGE UALIFIER KEYSTROKES 1 8 ˆ... -

Page 56: Buyer Qualifying

You can pre-qualify for a standard, fixed-rate P&I loan or an Interest- Only loan. The calculator gives you three types of qualifying answers for both standard P&I qualifying and Interest-Only qualifying: (1) Loan Amount available given buyer’s income and debt, (2) Income required given loan amount (or price/down payment) and (3) Actual Ratios given both income/debt and property data. - Page 57 (Cont’d) 5. When calculating Annual Income Required (based on entered loan amount or sales price, term, interest and stored qualifying ratios), the first press of q or Q will display your stored ratios, the second press in succession will display the Annual Income Required, and the third press in succession will show the Allowable Monthly Debt.

-

Page 58: Qualifying Examples

Recalling Income/Debt Qualifying Ratios Recall stored 28%-36% and 29%-41%ratios: STEPS Clear calculator Recall qualifying ratios 1 Recall qualifying ratios 2 Storing New Income/Debt Qualifying Ratios Enter and permanently store new qualifying ratios of 30% for Income... -

Page 59: Finding Qualifying Loan Amount And Sales Price (Simple Example Excluding Tax/Insurance)

Find monthly P&I payment p *Note: Tax and Insurance will need to be cleared if you’re continuing from a previous example where rates were stored. — DO NOT CLEAR CALCULATOR — Re-qualify this buyer assuming $200 per month in additional debt. STEPS... -

Page 60: Qualifying Loan Amount And Sales Price (Complete Example Including Down Payment, Tax/Insurance, Monthly Association Dues)

Recall interest* Recall term* Display qualifying ratios Find qualifying loan amount q Find price — DO NOT CLEAR CALCULATOR — Now find the monthly P&I payment, PITI payment, total payment, and interest-only payment: STEPS Find P&I payment Find PITI payment... -

Page 61: Restricted" Qualifying

Display qualifying ratios Find “restricted” qualifying loan amount — DO NOT CLEAR CALCULATOR — *Note: If you’re not continuing from the previous problem, you’ll need to re-enter inter- est, term, and in this case, property tax and insurance. “Unrestricted” Qualifying... -

Page 62: Qualifying Comparison (Comparing 2 Different Loans Or Ratios At Once)

Find Qual 1 qualifying loan q Find P&I payment Find PITI payment Find total payment Find interest-only payment p — DO NOT CLEAR CALCULATOR — STEPS Display Qual 2 stored ratios Q Find Qual 2 qualifying loan Q Find P&I payment... -

Page 63: Qualifying Loan Amount (Interest-Only Loan)

Enter interest Enter term Display ratios Find qualifying loan amount Find price — DO NOT CLEAR CALCULATOR — Find the monthly P&I payment, PITI payment, total payment, and Interest-Only payment: STEPS I/O payment P&I payment PITI payment Total payment 58 —... -

Page 64: Finding Income Required And Allowable Monthly Debt

30 years. Estimate property tax/insurance rates of 1.5% and 0.25%, respectively. Clear mortgage insurance rate to zero, as they are putting 20% down. STEPS Clear calculator Enter annual interest Enter term in years Enter tax rate Enter insurance rate... -

Page 65: Solving For Actual Qualifying Ratios

$65. Use 6.5% interest for 30 years. What are his actual ratios? What is the price of the home he can afford? What is the monthly payment? STEPS Clear calculator Enter interest Enter term Enter loan amount... -

Page 66: 1St And 2Nd Trust Deeds (Combo Loans)

1ST AND 2ND TRUST DEEDS (COMBO LOANS) Your calculator figures Combo loans, or 1st and 2nd Trust Deeds, which are common financing options for clients with smaller down payments, who want to avoid mortgage insurance. The benefit of Combo loans over single, fixed-rate loans with mortgage insurance is that the buyer can actually save money obtaining two loans vs. -

Page 67: Combo Loan (80:10:10) Vs. Fixed-Rate Loan With Mortgage Insurance

LOAN w/PMI Loan Amount 100,000 Interest Term 2.5% STEPS 1. Enter Fixed-Rate Loan Values and Find Total Payment: Clear calculator Enter loan amount Enter down payment Enter interest Enter term Enter MI (mortgage insurance) value Clear Tax register Clear Insurance register 0 I Solve for price Solve for P&I payment... - Page 68 (Cont’d) STEPS 3. Find 80:10:10 Combo Loan and Comparison Values (vs. Fixed- Rate Loan with Mortgage Insurance): Find 1st:2nd combined (blended) interest rate Find equivalent interest rate of single, fixed-rate loan with mortgage insurance Find total combined (1st/2nd) payment Find equivalent payment of single, fixed-rate loan with mortgage insurance Find monthly savings over fixed-rate loan with...

-

Page 69: Insurance

LOAN w/MI Loan Amount 100,000 Interest Term STEPS 1. Enter Fixed-Rate Loan Values and Find Total Payment: Clear calculator Enter Loan Amount Enter Down Payment Enter annual Interest rate 7 ˆ Enter Term in years Enter MI (mortgage insurance) rate... - Page 70 (Cont’d) STEPS 3. Find 80:10:10 Combo Loan with an Interest-Only 2nd TD and Comparison Values (vs. Fixed-Rate Loan with Mortgage Insurance): Find 1st:2nd blended interest rate Find equivalent interest rate of single, fixed-rate loan with MI Find total combined (1st/2nd) payment Find equivalent payment of single, fixed-rate loan with MI...

-

Page 71: Combo Loan - Entering A New Ltv

Loan Amount 100,000 Interest Term 100% STEPS 1. Enter Fixed-Rate Loan Values and Find Total Payment: Clear calculator Enter Loan Amount Enter annual Interest rate 7 ˆ Enter Term in years Enter MI (mortgage insurance) rate Clear property tax rate... - Page 72 (Cont’d) STEPS 3. Find 80:20 Combo Loan and Comparison Values (vs. Fixed-Rate Loan with Mortgage Insurance): Enter LTV and find 1st:2nd blended interest rate Find equivalent interest rate of fixed-rate loan with MI Find total combined (1st/2nd) payment Find equivalent payment of fixed-rate loan with MI Find monthly savings over fixed-rate loan with MI...

-

Page 73: Financed Mortgage Insurance Compared To A Combo Loan

Enter annual Interest rate 6 ˆ Calculate monthly MI premium Enter monthly MI premium into mortgage insurance — DO NOT CLEAR CALCULATOR — 3. Enter loan values: Enter Loan Amount Enter Term in years Enter annual Interest rate 6 ˆ... - Page 74 Note: the Financed MI is better when compared to the Combo loan with a monthly savings of $10.08. — DO NOT CLEAR CALCULATOR — What happens if you compared to a 20 year 2nd Trust Deed at a rate of 8%? Typically, the monthly payment savings will be greater.

-

Page 75: Appendix

Keystroke Reset — Returning the Calculator to its Original Factory Settings You may at times want to reset your calculator to its factory settings (i.e., reset all registers and Preference Settings to their original default values). To do this, turn off the calculator, hold down the x key, and then turn it back on. -

Page 76: Auto Shut-Off

Insert two new LR44 button-cell batteries, making sure they’re facing positive-side (+) up. Close the battery door. Note: Replacement batteries are available at most camera or electronics stores. You may also call Calculated Industries at 1-800-854-8075. Repair and Return Warranty, Repair and Return Information! Return Guidelines: 1. -

Page 77: Warranty

SUMED TO BE DAMAGES RESULTING FROM MISUSE OR ABUSE. To obtain warranty service in the U.S., ship the product postage paid to Calculated Industries (address listed on the last page). Please provide an explanation of the service requirement, your name, address, day phone number and dated proof of purchase (typically a sales receipt). -

Page 78: Legal Notes

This equipment has been certified to comply with the limits for a Class B computing device, pursuant to Subpart J of Part 15 of FCC rules. Software copyrighted and licensed to Calculated Industries, Inc., by Real Estate Master Technologies, LLC, 2006. -

Page 79: Index

Basic Operation Keys, 1 Batteries, 71 Bi-Weekly Loans, 47 BUYER QUALIFYING, 51 CALCULATOR SETTINGS, 16 Combo Loan (80:10:10) vs. Fixed-Rate Loan with Mortgage Insurance, 62 Combo Loan (Interest-Only 2nd) vs. Fixed-Rate Loan with Mortgage Insurance, 64 Combo Loan—Entering New LTV, 66... - Page 80 Mortgage Loan (TVM) Keys, 2 MORTGAGE LOANS/TIME-VALUE-OF-MONEY (TVM) EXAMPLES, 22 Non-Monthly Loans, 27 Odd-Days Interest and APR, 46 Paying Off a Loan Early (Making Larger Payments), 25 Percentage Calculations, 13 PITI Payment (Tax and Insurance Entered as %), 32 Preference Settings, 17 Qualifying Comparison, 57 QUALIFYING EXAMPLES, 53 Qualifying Keys, 8...

- Page 81 Designed in the United States of America Printed in China UG3416E-A 1/06...

Need help?

Do you have a question about the 3416 and is the answer not in the manual?

Questions and answers