Summary of Contents for Calculated Industries 3405

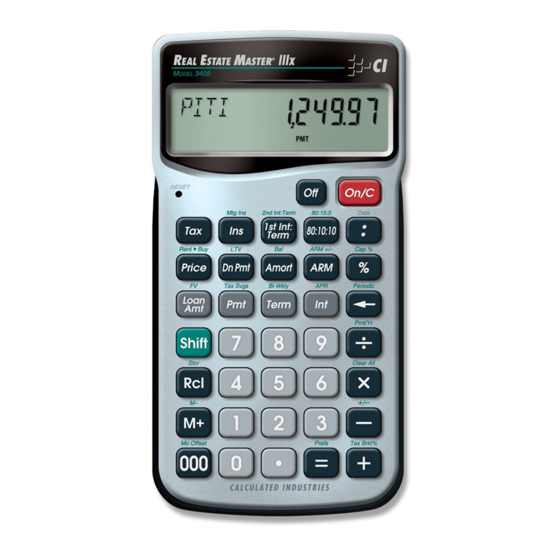

- Page 1 STATE ASTER ® RESIDENTIAL REAL ESTATE FINANCE CALCULATOR Model 3405 Pocket Reference Guide...

- Page 2 • Estimated Income Tax Savings/Deduction • Adjustable Rate Mortgages (ARMs) • Amortization and Remaining Balance • Bi-Weekly Loans • Date Math Problems • New! APR, including MI • New! 80:10:10/80:15:5 Combo Loans OCKET ASTER STATE ASTER EFERENCE ® calculator — 1 UIDE...

-

Page 3: Table Of Contents

TABLE OF CONTENTS KEY DEFINITIONS ...4 Preference Settings — How to Access ...9 EXAMPLES ...11 Memory — Add/Subtract/Multiply ...11 Memory/Storage Registers...12 Finding Commission ...12 Reduction of Listing Price...13 Date of Escrow Closing ...13 Monthly Mortgage (P&I) Payment ...14 Term of a Loan ...14 Interest Rate ...15 Loan Amount ...15 Loan Amount Based on Sales Price... - Page 4 Amortization for Individual Year(s)— Month Offset, Tax Bracket Change ...26 Balloon Payment/Remaining Balance...28 APR and Total Finance Charges, Including Mortgage Insurance ...29 Prepaid (Odd-Days) Interest and APR, Including Mortgage Insurance ...30 Appreciation/Future Value ...32 Bi-Weekly Loans...33 80:10:10 Combo Loan vs. Fixed-Rate Loan with Mortgage Insurance...34 80:15:5 Combo Loan vs.

-

Page 5: Key Definitions

KEY DEFINITIONS ® µ s – OCKET Colon separator (used for dates, ARMs, Amortization ranges, and Combo loans) Backspace key; for back- ing up/deleting wrong entry Recalls or re-displays a value when followed by a chosen key (e.g., ® ˆ will display current interest value) Memory Function:... - Page 6 s ÷ ˆ OCKET Clear All (Note: perform with caution as it will clear/reset stored values) Preference mode (see pg. 9 for details) Payments per year (Default 12, for monthly) Periodic (identifies entry as periodic instead of yearly) Month offset Odd-days interest Tax bracket % Estimated tax...

- Page 7 s ˆ OCKET APR (annual percentage rate), including mortgage insurance, if entered Sales price of property Down payment Bi-Weekly loan Amortization function Remaining balance Adjustable-rate mortgage ARM decreasing interest % adjustment ARM lifetime interest cap Property tax (enter as per- cent or dollar amount)* Property/homeowner’s insurance (enter as per-...

- Page 8 OCKET Mortgage insurance (enter as percent or dollar amount)* *Note: Once Tax/Insurance % (or $) values are entered — as well as TVM values — the second press of t I , or press of s I I will compute the $ (or %);...

- Page 9 OCKET Combo loan function for an 80:10:10 LTV loan; calcu- lates 1st/2nd TD values and compares them to entered fixed-rate loan w/mortgage insurance *You may enter any LTV prior to pressing this key (e.g., LTV of 90:5, enter 9 0 : 5 * ) Combo loan function for an 80:15:5 loan;...

-

Page 10: Preference Settings - How To Access

Preference Settings — How to Access Press s , then = , then keep pressing = to toggle through the main settings. Press the + key to advance within sub- setting. Use the – key to back up. Press any key to exit mode. Press s and then: 1st press of =... - Page 11 (Cont’d) 4th press = Mortgage Insurance 5th press = Amortization Display 6th press = Qualifying Ratios: *e.g., 5 a amortizes for payment numbers 49-60 (only 5th year) **e.g., 5 a amortizes for payment numbers 1-60 (years 1-5) OCKET (Cleared or Stored): --Clears MI ($ or %) @ --Clears MI ($ or %) @ Off --Holds only MI % at Off...

-

Page 12: Examples

EXAMPLES Memory — Add/Subtract/Multiply Add 1,500 and 2,650 to the cumulative Memory (M+). Compute subtotal, then subtract 2,000 and find total. STEPS Clear Add 1st # Add 2nd# Find total Subtract Find total and clear Memory Store 55 and multiply by 40. Then recall Memory Total and multiply it by 60. -

Page 13: Memory/Storage Registers

Memory/Storage Registers Store 10, 20, 30 into Memory Storage keys M0-M2 and recall each value. Then clear all stored numbers. STEPS Clear Store 1st # Store 2nd # Store 3rd # Recall 1st # (Repeat for 1 and 2 ) Clear All Note: There are additional Storage Registers s ®... -

Page 14: Reduction Of Listing Price

Reduction of Listing Price A seller is anxious to sell his home and wishes to reduce the listing price by 5%. What is the new price, if it is now listed at $346,000? STEPS Clear Enter price Subtract 5% Find new listing price Date of Escrow Closing If a 45-day escrow begins June 15, 2004,... -

Page 15: Monthly Mortgage (P&I) Payment

Monthly Mortgage (P&I) Payment Find the monthly (P&I) payment on a 30- year, fixed-rate loan of $265,000 at 6.75% annual interest: STEPS Clear Enter loan Enter term Enter interest 6 • 7 5 ˆ Find payment p Term of a Loan How long does it take to pay off a loan of $15,000 at 10% interest if you make pay- ments of $200 each month? -

Page 16: Interest Rate

Interest Rate Find the interest rate on a mortgage if the loan amount is $98,500, term is 30 years and payment is $1,150 a month: STEPS Clear Enter loan Enter term Enter payment 1 1 5 0 p Find annual interest Find periodic interest... -

Page 17: Loan Amount Based On Sales Price And Down Payment

Loan Amount Based on Sales Price and Down Payment Find both down payment dollar amount and loan amount if the sales price is $375,500 and you're planning to put 20% down: STEPS Clear Enter price Enter down% 2 0 d* Find down$ Find loan *You do not have to label the value as a percent. -

Page 18: Setting Tax And Insurance

Setting Tax and Insurance Enter an annual property tax rate of 1.5%, a property/homeowner’s insurance rate of 0.25% and a mortgage insurance rate of 0.50%: STEPS Set tax%* Set insurance% • 2 5 I Set mortgage insurance% • 5 0 s I *Note: Do not label as a percent, or use the % key;... -

Page 19: P&I, Piti And Interest-Only Payments

P&I, PITI and Interest-Only Payments • Term: 30 years • Interest: 6.25% • Sales price: $325,000 • Down payment: 5% • Property tax: 1.3% • Property insurance: 0.25% • Mortgage insurance: 0.45% STEPS Clear Enter term Enter interest 6 • 2 5 ˆ Enter price Down% Set tax%*... -

Page 20: Quarterly Payment

Quarterly Payment Find the quarterly payment on a 10-year loan of $15,000 with an annual interest rate of 12%: STEPS Clear Set to 4 payments per year Enter loan Enter term Enter interest 1 2 ˆ Find quarterly payment Return to 12 payments per year OCKET KEYSTROKES... -

Page 21: Estimated Tax Savings

Estimated Tax Savings • Loan: $150,000 • Buyer’s tax bracket: 28% • Term: 30 years • Interest: 8% • Property taxes: $1,500 • Property insurance: $250 Note: This is only an estimate. What is this buyer’s estimated income tax savings and “after tax” payment? STEPS Clear Enter term... -

Page 22: Rent Vs. Buy

Rent vs. Buy • Term: 30 years Property Tax: 1.25% • Interest: 7.5% • Down: 10% If your client is currently renting at $1,250/month, find the comparable home price, loan and estimated income tax sav- ings (at 30% tax bracket). STEPS Clear Enter term... -

Page 23: Arm Payment - Increasing And Decreasing Payments

ARM Payment — Increasing and Decreasing Payments • Loan: $225,000 • Term: 30 years • Start interest: 4.25% • 1st ARM interest adjustment: increases 1% after 6 months • 2nd ARM adjustment: decreases 1.5% at end of 1st year • 3rd ARM adjustment: increases 1.25% at end of 2nd year and continues to increase each year thereafter •... - Page 24 (Cont’d) STEPS Find “adjusted” higher payment for next 6 months Enter 2nd ARM parameters 1 • 5 : 1 s A Find Year 2 “adjusted” lower payment Enter 3rd ARM parameters 1 • 2 5 : 1 A Find Year 3 “adjusted” increased payment Find Year 4 “adjusted”...

-

Page 25: Amortization - Using "Next" Feature

Amortization — Using “Next” Feature • Loan: $300,000 • Term: 30 years • Interest: 7.5% • Start Month: January • Tax Bracket: 28% (Default) STEPS Clear Enter loan Enter interest 7 • 5 ˆ Enter term Find payment p Find # payments a Find total interest Find total... - Page 26 (Cont’d) STEPS Find total payments Find balance a Remaining term a Tax deduction a *estimated – mortgage interest only; doesn’t include property tax. Find all values for the second year: STEPS Display Year 2 a Find total interest Find total principal Find total payments...

-

Page 27: Amortization For Individual Year(S)- Month Offset, Tax Bracket Change

Amortization for Individual Year(s) — Month Offset, Tax Bracket Change • Loan: $300,000 • Term: 30 years • Interest: 7.5% • Start Month: March • Income Tax Bracket: 30% Amortize & find mortgage interest deduc- tion for Year 1, if loan starts in March: STEPS Clear Set Month Start to... - Page 28 Return tax bracket to to 28% *Note: Remember to reset Month Offset to 1 and tax bracket to 28 (the calculator’s default settings) for performing other examples within this guide. Check these settings by pressing ® ) and ® + .

-

Page 29: Balloon Payment/Remaining Balance

Balloon Payment/Remaining Balance • Loan: $300,000 • Term: 30 years • Interest: 7.5% Find remaining balance after 10 years: STEPS Clear Enter loan Enter interest 7 • 5 ˆ Enter term Find payment p Find balloon payment, or remaining balance OCKET KEYSTROKES 3 0 0 ) l... -

Page 30: Apr And Total Finance Charges, Including Mortgage Insurance

APR and Total Finance Charges, Including Mortgage Insurance • Loan: $250,000 • Term: 30 years • Interest: 7% • Cost: 1.5 points + $550 • Mortgage insurance (MI): $1,200/year STEPS Clear Enter loan Enter term Enter interest 7 ˆ Find payment p Enter MI Find Loan Costs: Recall loan... -

Page 31: Prepaid (Odd-Days) Interest And Apr, Including Mortgage Insurance

Prepaid (Odd-Days) Interest and APR, Including Mortgage Insurance • Loan: $350,000 • Term: 30 years • Interest: 6% • Cost: 1.5 points + $750 • Mortgage insurance (MI): $2,200/year • Escrow Closes: 7/21/03 • 1st Payment Due: 8/1/03 STEPS Clear Enter loan Enter term Enter interest 6 ˆ... - Page 32 (Cont’d) Find Loan Costs: STEPS Recall loan Find points Add fees and find total Add prepaid interest stored in memory Find APR Find total charges Amount financed Total cost P&I payment ˆ Monthly MI PIMI payment ˆ Clear All *APR includes points/fees, prepaid interest, and, like the previous example, it also includes the cost of mortgage insurance (an optional entry).

-

Page 33: Appreciation/Future Value

Appreciation/Future Value What will a $350,000 home be worth in 3 years, figuring an inflation or appreciation rate of 6%? STEPS Clear Set to 1 payment per year Enter PV Enter term Enter approximate rate Find FV Reset payments per year OCKET KEYSTROKES 1 s ÷... -

Page 34: Bi-Weekly Loans

Bi-Weekly Loans • Loan: $212,500 • Term: 30 • Interest: 7.85% Find the Bi-Weekly term, savings, interest savings, total cost, and Bi-Weekly payment: STEPS Clear Enter loan Enter term Enter interest 7 • 8 5 ˆ Find P&I payment Find Bi-Weekly term Find total interest savings... -

Page 35: 80:10:10 Combo Loan Vs. Fixed-Rate Loan With Mortgage Insurance

80:10:10 Combo Loan vs. Fixed-Rate Loan with Mortgage Insurance Compare an 80:10:10 Combo Loan vs. a Fixed-Rate loan w/mortgage insurance. The loan parameters are: Loan Interest Term STEPS 1. Enter Fixed-Rate Loan Values and Find Total Payment: Clear Enter loan OCKET FIXED w/PMI... - Page 36 (Cont’d) STEPS Enter interest 6 • 5 ˆ Enter term Enter MI% Clear Tax Clear Insurance 0 I Solve for payment Solve for PITI (including PMI) 2. Enter Combo Loan Values: Enter 1st TD Interest and Term 6 : 3 0 ! Enter 2nd TD Interest and Term 8 •...

- Page 37 (Cont’d) STEPS Find 1st/2nd TD combined monthly payment Find equivalent payment for fixed-rate loan with mortgage insurance * Display monthly savings over fixed-rate loan with mortgage insurance * Display adjusted 2nd term (if savings applied to 2nd TD) Find 1st TD loan amount Find 2nd TD loan amount...

-

Page 38: 80:15:5 Combo Loan Vs. Fixed-Rate Loan With Mortgage Insurance

80:15:5 Combo Loan vs. Fixed-Rate Loan with Mortgage Insurance Compare an 80:15:5 Combo Loan vs. a Fixed-Rate loan w/mortgage insurance. The loan parameters are: Loan Interest Term STEPS 1. Enter Fixed-Rate Loan Values and Find Total Payment: Clear Enter loan Enter interest 6 ˆ... - Page 39 (Cont’d) STEPS Clear Insurance* Solve for payment Solve for total payment (including PMI) *Skip to p if continuing from the last example, as rates are already cleared. 2. Enter Combo Loan Values: Enter 1st TD Interest and Term 5 • 2 5 : 3 0 Enter 2nd TD Interest and Term 7 : 1 5 s 3.

- Page 40 (Cont’d) STEPS Find equivalent payment for fixed-rate loan with mortgage insurance * Display monthly savings over fixed-rate loan with mortgage insurance * Display adjusted 2nd term (if savings applied to 2nd TD) Find 1st TD loan amount Find 2nd TD loan amount Find 1st TD payment...

-

Page 41: Appendix

APPENDIX Default Settings Performing a Reset will return your calcu- lator to the default settings below: • 12 Periods per Year • Property Tax/Ins. = % Rates Not Permanently Stored/Clears Upon O • Mortgage Ins. = % Rates Not Permanently Stored/Clears upon o o •... -

Page 42: Batteries

Class B computing device, pursuant to Subpart J of Part 15 Software copyrighted and licensed to Calculated Industries, Inc., by Real Estate Master Technologies, LLC, 2004. User's Guide copyrighted by Calculated Industries, Inc., 2004. - Page 43 REAL ESTATE MASTER ® CALCULATED INDUSTRIES ® registered trademarks of Calculated Industries, Inc. ALL RIGHTS RESERVED CALCULATED INDUSTRIES ® 4840 Hytech Drive Carson City, NV 89706 U.S.A. 1-800-854-8075 Fax: 1-775-885-4949 E-mail: info@calculated.com www.calculated.com 3405PRG-E-B 12/03 — 42 OCKET EFERENCE UIDE...

Need help?

Do you have a question about the 3405 and is the answer not in the manual?

Questions and answers