HP 10BII Manual

- User manual ,

- Owner's manual (146 pages) ,

- Quick start manual (8 pages)

Advertisement

HOW TO USE THIS PRODUCT

This workbook and the pre course videos are designed to give you a quick overview of the calculator and an introduction to time value of money. These skills are also covered in depth in the training.

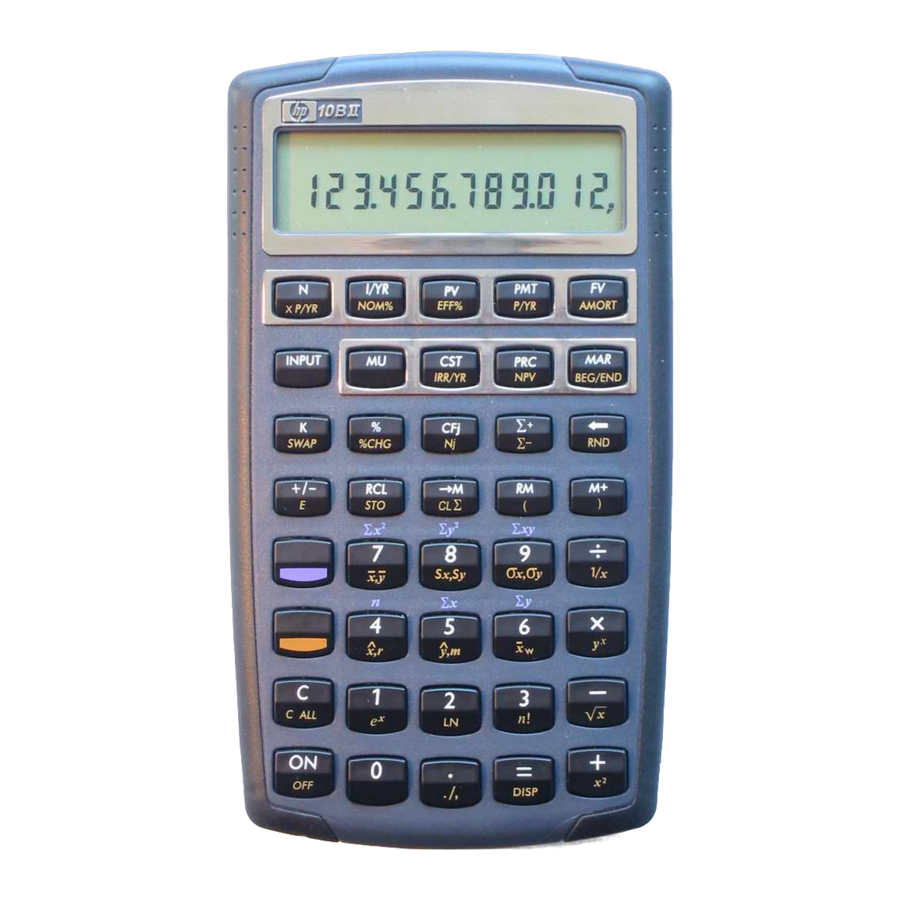

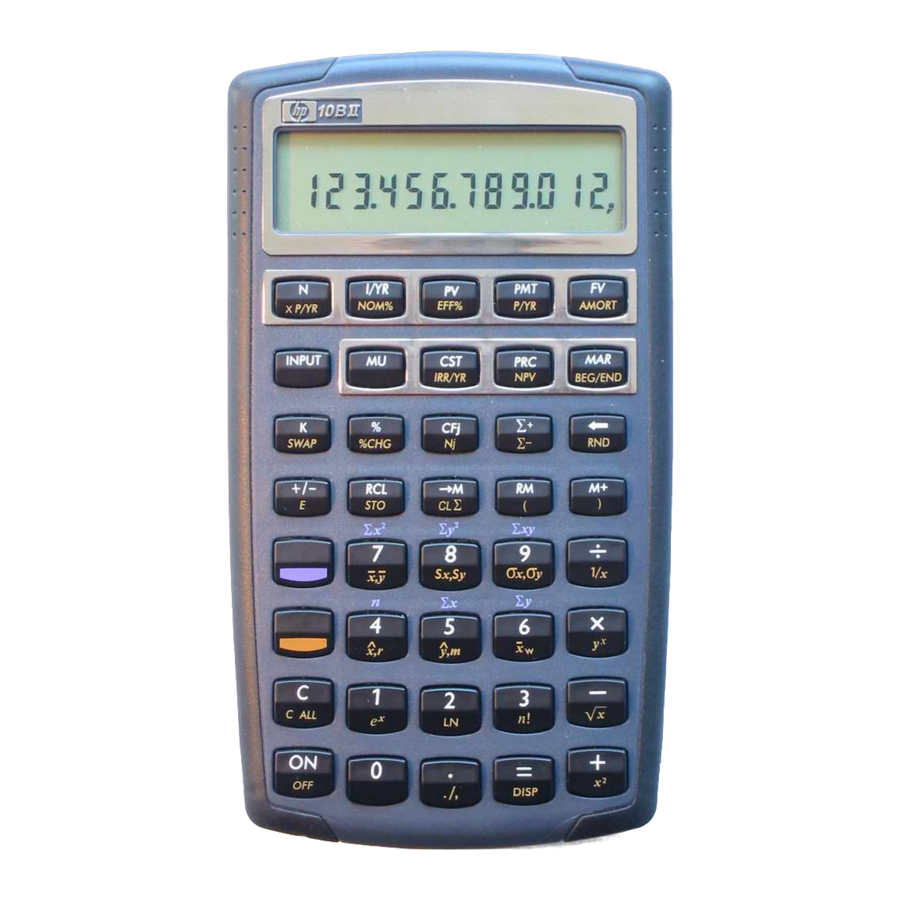

The HP 10BII Financial Calculator

To take Does it Pencil, you must have either the physical calculator or the smart phone app as a part of this course. Please get your 10BII as soon as you can. You will need it to go through this workbook and watch the videos.

What's in this Workbook & Videos

This workbook and the videos will focus on the basic set ups, steps, and keypresses of using the HP 10BII and doing time value of money.

Most people who take Does it Pencil training have never done the things in this workbook. If it doesn't make sense right now, don't worry about it. This workbook and these videos are here to give you a first exposure to all of these things, it will all make more sense in the live course.

The thousands of student who have come before you all agree at the end that taking the time to do this before you attend the training will be a HUGE help at your event.

There are 4 videos in the Pre-Course training:

- Calculator Set Ups

- Time Value of Money Discussion

- Time Value of Money Example

- Entering Cash Flows

Which App?

Some people like to use the hard calculator.

It's tactile and it has real keys.

Some people prefer an app.

If you want the app, get the one with this logo

Links are provided on the Pre-Course page.

The HP10BII+ is the newer version of the calculator. It's fine.

What to do Next

Get your HP 10BII calculator or smart phone app

Watch the videos

Do the problems

INTRODUCTION TO THE UNIT

Default Settings

There are 3 defaults you need to use on the calculator:

- set the beginning of year (BOY) or end of year (EOY) modes

- clear the registers

- set the number of digits displayed for calculation (significant places)

BOY and EOY Settings

The HP 10BII has the ability to make calculations contemplating receiving and making payments at the beginning of the period or at the end of the period. In CRASH COURSE training we will assume that the investor receives the benefits of all cash flows for the entire period. This is called the "end of year" setting (EOY). If you see the word "BEGIN" in your display, it needs to be turned off, or set to end of year. If you do not see the word "BEGIN" in the display, the calculator is set on end of year (EOY).

keystrokes

![]() END

END

description

press the "GOLD" key, then the BEG/END Key

Clearing the Registers

The HP 10BII allows you to save information in some registers while it is cleared in others.

- making corrections before a number is entered

- clearing the last entry

- clearing all registers

Making Corrections Before a Number is Entered

keystrokes

![]()

description

![]() clears the last digit in the display otherwise it cancels the current calculation

clears the last digit in the display otherwise it cancels the current calculation

Clearing the Last Entry

keystrokes

C

description

clears the last entry

Clearing all Registers

keystrokes

![]() CALL

CALL

description

clears all memory functions

Set the Significant Places

On the HP 10BII calculator, changing the number of digits shown to the right of the decimal point will not affect the internal iteration of the calculator. The calculator will always performs tasks and store digits up to 12 places. EXCEPTION: when performing mortgage loan calculations (discussed later), the calculator will round to the number of places you have preset in the calculator.

keystrokes

![]() DISP #

DISP #

description

press the GOLD key, then the "=" key, then the number of digits desired to be displayed to the right of the decimal point.

For example, to display 4 significant places, press ![]() DISP 4. You will see 0.0000

DISP 4. You will see 0.0000

TIME VALUE OF MONEY INTRODUCTION

The 5 Time Value of Money Keys

The Top Row

There are 5 fundamental "time value of money" keys on the top row of the HP10BII calculator. They are:

| N | The number of time "periods". Note: this is not always the number of years, rather the number of "periods" (i.e 12 periods in a year, 4 periods in a quarter). |

| I/YR | The "rate", "interest rate", or "yield". |

| PV | Present Value is the "worth" today of money received or paid. |

| FV | Future Value is the "worth" in the future of money received or paid. |

| PMT | The payment. Investors receive (or pay) a series of payments throughout the holding cycle of an investment. Payments can be positive or negative. The notation used to make a number "negative" is referred to as "sign convention". NOTE: In this workbook, a negative sign convention will be denoted by "< >" or "-". |

The Relationship of I/YR and N

When performing time value of money calculations, you will need to preset the calculator for the correct number or payments per year to make the conversions required for I/YR and N.

TIME VALUE OF MONEY EXAMPLES

In Video 3 I will give you a quick example of using the 10BII to do Time Value of money. The setup, sequence and keystrokes are always the same. The problem I will show is this:

Example 1

Borrow $100,000

30 year amortization

1 payment per year.

Example 2

Borrow $100,000

30 year amortization

12 payments per year.

ENTERING CASH FLOWS INTO THE UNIT

| Time Period | Description | Symbol |

| 0 | pay out $95,000 | <95,000> |

| 1 | receive $4,895 | $4,895 |

| 2 | receive $4,895 | $4,895 |

| 3 | receive $4,895 + $289,049 | $293,944 |

Note: The are two ways to enter cash flows (CF's) depending on whether you are using the hard calculator or which phone app you have.

This video shows the same problem with both available interfaces.

If you have the app, tap the CFj key on your calculator (3rd row, middle). If your device takes you to a different screen and menu, the first part of this video is for you.

If you have the app, tap the CFj key on your calculator (3rd row, middle). If your device keeps you on the same home screen, or if you are using the hard calculator, the second part of this video is for you.

Again, if you've never seen this before, don't worry about it. Just follow along with the video and everything will be explained at your course.

DOESTPENCIL.COM

Documents / ResourcesDownload manual

Here you can download full pdf version of manual, it may contain additional safety instructions, warranty information, FCC rules, etc.

Advertisement

Need help?

Do you have a question about the 10BII and is the answer not in the manual?

Questions and answers