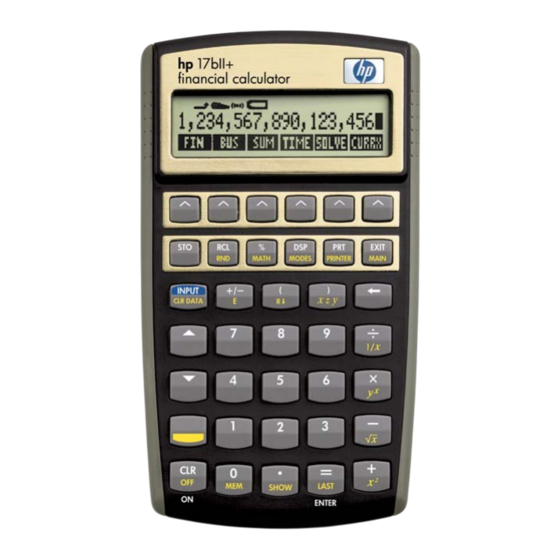

HP 17bII+ Instruction Manual

Hide thumbs

Also See for 17bII+:

- Owner's manual (140 pages) ,

- Quick start manual (39 pages) ,

- Instruction manual (10 pages)

Summary of Contents for HP 17bII+

- Page 1 HP 17bII+ Discounting & Discounted Cash Flow Analysis It's About Time The Financial Registers versus Discounted Cash Flow Discounting a Single Sum Discounting and Compounding Discounting a Series of Sums Editing Contrasting Annuities...

- Page 2 But there is a difference in using the financial registers and using the discounted cash flow functions in your HP 17bll+. It has to do with the cash flows in the future that you are discounting.

- Page 3 HP 17bII+ Discounting & Discounted Cash Flow Analysis value as a negative) and at the end of ten years you would have $40,000. (in future value as a positive). That is, the $40,000. ten years from now and the $18,528. today are equal in value but separated by time, under the conditions given in this example of 8% annual discounting and a 10-year time span.

- Page 4 HP 17bII+ Discounting & Discounted Cash Flow Analysis We are going to consider what we pay for an asset when we talk about net present value and internal rate of return in another section. For now we will look only at future incomes. So, press ‘0’ and ‘INPUT.’ That keeps cash flow 0 at zero and moves you to the next cash flow.

- Page 5 HP 17bII+ Discounting & Discounted Cash Flow Analysis This means that the value today of the three future cash flows we entered discounted at 10% is $93,764. (rounded). Another way to look at it is if you purchased an asset for $93,764. and you earned those three cash flows, you would be making a 10% return per period on your investment of $93,764.

- Page 6 HP 17bII+ Discounting & Discounted Cash Flow Analysis Consecutive, Equal Cash Flows Put in the third cash flow with ‘100000’ and ‘INPUT.’ This time, however, we want it more than one time, don’t we. That is because this cash flow is the same for each period from period 3 through period 7. That is five straight periods. So, when you get to “#TIMES(3)=1”...

- Page 7 HP 17bII+ Discounting & Discounted Cash Flow Analysis the first period’s cash flow in “FLOW(0),” the second in “FLOW(1),” thereby pulling up all the cash flows from the end to the start of a period. For the series we just completed, the $75,000. would go into “FLOW(0),” the ($25,000.) into “FLOW(1)” and so on. This will make the cash flows worth more, since they are going to be received earlier.

Need help?

Do you have a question about the 17bII+ and is the answer not in the manual?

Questions and answers