Advertisement

Quick Links

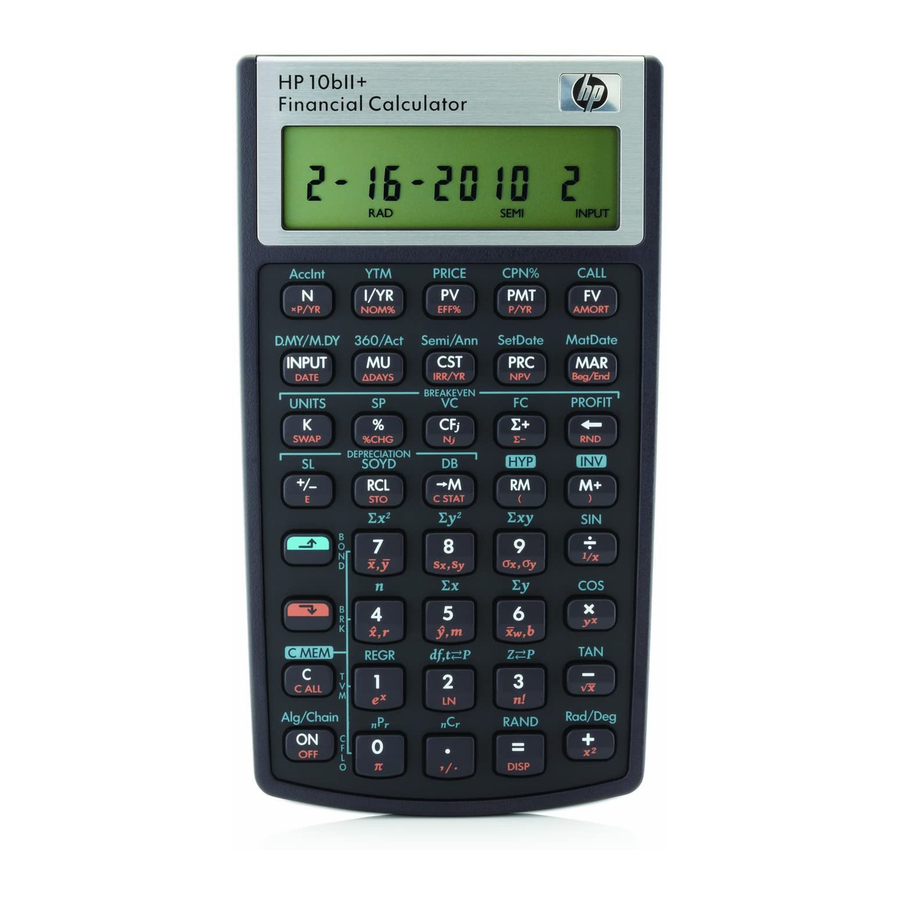

The HP10BII is programmed to perform two basic types of operations: statistical operations and

financial operations. Various types of computations are activated by depressing the mauve or orange

"shift" keys located in the leftmost column of keys on the keypad. The mauve colored shift key

activates mainly statistical functions and operations indicated in mauve written above some of the

keys on the keypad. The orange colored shift key activates mainly financial functions and operations

indicated on the bottom half of most of the keys on the keypad.

The HP 10BII has continuous memory. Therefore, turning of the calculator does not affect the

information you have previously stored in the calculator. If not turned off manually, the calculator will

turn off automatically approximately 10 minutes after last use. The HP 10BII uses two lithium

batteries and has a low battery indicator symbol which is activated when battery power is low

indicating the need to replace them.

It is worth noting that the cursor ( _ ) is visible when you are entering a number and that using the

back key (? ) will erase the last digit entered and visible on the display. When the cursor ( _ ) is not

visible, then pressing the back key (? ) will clear the entire display and cancel any pending

calculation. When you are entering a number, pressing (C) also clears it to zero.

This guide uses the notation OS to indicate the selection of the orange shift key.

A.

Turning the calculator on and off, clearing the display, clearing error messages, clearing

memory, and setting the decimal points:

Keystrokes

1.

ON

1

2.

OS

ON

3.

C

4. ? or C

5.

OS

C All

1

The keystroke symbol OS indicates the need to depress the orange shift key located in the left column of the keypad at the third

position from the bottom.

2

Modes on the HP 10 BII include (a) the number of payments assumed to occur each year, (b) whether payments occur at the

beginning or the end of the year, and (c) and the number of decimals displayed.

VI. Hewlett Packard (HP) 10BII

Display

0.00

0.00

Description

Turns the calculator on.

Turns the calculator off.

Clears the display of its

current contents and cancels

the current calculation.

Clears any error message and

restores the original contents

of the display.

Clears all memory. Does not

2

reset modes.

Advertisement

Summary of Contents for HP HP10BII

- Page 1 Modes on the HP 10 BII include (a) the number of payments assumed to occur each year, (b) whether payments occur at the beginning or the end of the year, and (c) and the number of decimals displayed.

- Page 2 “float.” Using the memory capability: The HP 10BII can store numbers for re-use in several different ways: ?? Use the (K) or constant key to store a number and its operator for repetitive operations. ?? Use the 3 key memory [(? M), (RM), and (M+)] to store, recall, and sum numbers respectively.

- Page 3 Example: Use the M register to add 17, 14, and 16. Then subtract 4 and recall the result. Keystrokes Display Description (1) (7) (? M) 17.00 Stores 17 in the M register. (14) (M+) 14.00 Adds 14 to M register. (16) (M+) 16.00 Adds 16 to M register.

- Page 4 Time Value Basics: Clearing time value of money (TVM) registers, setting beginning and end-of-period modes, and establishing interest rate compounding frequency. Keystrokes Display Description Clear all memory including TVM. 1. (OS) (C ALL) 0.00 Clears Time-Value-of-Money worksheet. This sets N, I/YR, PV, PMT, and FV to zero and briefly displays the current value of P/YR.

- Page 5 Keystrokes Display Description Clear all memory. (OS) (C ALL) 0.00 Clears Time-Value-of-Money worksheet. (65000) (FV) 65,000.00 Enter $65,000 as the future value. 3. (18) (N) 18.00 Enter the number of periods of 18 months. 4. (15) (I/Y) 15.00 Enter the annual interest rate of 15%.

- Page 6 5. (10) (I/Y) 10.00 Enter the annual interest rate of 10%. (FV) -2,238.50 Computes the future value of $1,850 deposit earning 10 percent annual interest after 2 years. F. Calculating the present value of an annuity: Example: How much should you invest now so that, starting one year from today, your daughter can receive $6,000 per year for the next five years? Assume the discount rate is 15%.

- Page 7 Keystrokes Display Description Clear all memory. (OS) (C ALL) 0.00 Clears Time-Value-of-Money worksheet. (1) (OS) (P/YR) (C) 0.00 Sets the frequency of compounding to once per year and clears the register. (OS) (BGN/END) 0.00 In addition to the 0.00 on the LED display, the word BEGIN should now appear indicating beginning of the period...

- Page 8 (1) (OS) (P/YR) (C) 0.00 Sets the frequency of compounding to once per year and clears the register. 3. (2000) (PMT) 2,000.00 Enter $2,000 as the annuity payment. (5) (N) 5.00 Enter the number of periods of 5 years. 5. (11.4) (I/Y) 11.4 Enter the annual interest rate of 11.4%.

- Page 9 6. (11.4) (I/Y) 11.4 Enter the annual interest rate of 11.4%. (FV) -13,986.35 Computes the future value of a $2,000 beginning -of-the- period annuity earning 11.4 percent annual interest for 5 years. Calculating the net present value (NPV) of a series of equal or uneven cash flows using the cash flow (CFj) register.

- Page 10 Calculating the internal rate of return (IRR) of a series of equal or uneven cash flows using the cash flow (CFj) register. Example: ABC Inc. is planning to spend $35,000 to buy a warehouse. Under the contract, the y will receive an after-tax cash flow of $6,000 (paid semiannually) from the property for the next eight years.

- Page 11 Keystrokes Display Description Clear all memory. (OS) (C ALL) 0.00 Clears Time-Value-of-Money worksheet. (1) (OS) (P/YR) (C) 0.00 Sets the frequency of compounding to once per year and clears the register. 3. (100) (PMT) 100.00 Enter $100 as the annuity payment.

Need help?

Do you have a question about the HP10BII and is the answer not in the manual?

Questions and answers