Advertisement

Table of Contents

- 1 General Information

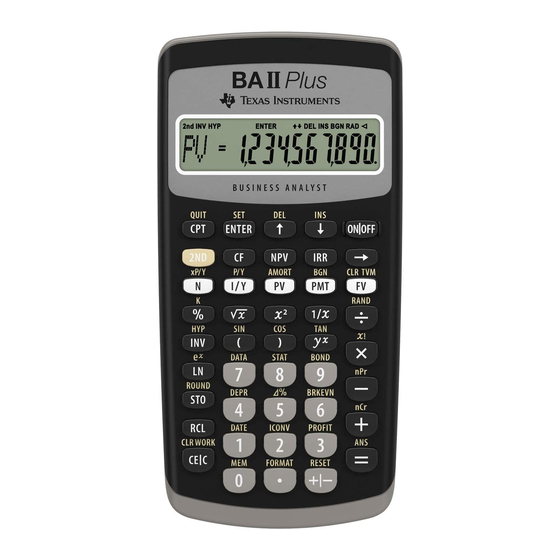

- 2 Product View

- 3 Financial Calculations

- 4 Sample Calculation of the Future Value (FV) of a Single Payment

- 5 Calculating the Future Value of an Annuity

- 6 Calculating the Payment of a Personal or Mortgage Loan

- 7 Sample Calculation of a Personal Loan Repayment

- 8 Sample Calculation of a Mortgage Loan Repayment

- 9 Self-Evaluation Exercise

- 10 Answer Sheet

- Download this manual

See also:

User Manual

Advertisement

Table of Contents

Summary of Contents for Texas Instruments BA II Plus

- Page 1 April 2007...

- Page 2 ENERAL NFORMATION The Texas Instrument BA II Plus financial calculator was designed to support the many possible applications in the areas of financial analysis and banking.

- Page 3 The explanations below will make it easier for you to use the calculator. By default, the calculator operates in financial mode. The ON/OFF key is used to turn the calculator on and off. The 2ND key is often used to access financial applications. Press this key when you want to apply the functions displayed in yellow at the top of the keys.

- Page 4 The BGN function lets you activate the beginning-of-period or the end-of-period payment. To understand the configuration of this function, simply press the 2ND and BGN keys. To the left of your screen, you will then see the END or BGN letters. To activate the beginning-of-period payment calculation, simply press the 2ND, BGN, 2ND and SET keys.

- Page 5 INANCIAL CALCULATIONS Most financial calculations are carried out using the following seven keys: Financial keys These keys are used to designate or calculate: The number of periods. The nominal interest rate. The present value of an investment. The future value of an investment. The periodic payment of an amortized loan or a split annuity.

- Page 6 Insurer A Sequence of entries Display Explanation CE/C > 2ND > CLR TVM Resets the default values. 2ND > P/Y > 1 > ENTER P/Y = 1 Enters an annual payment period. CE/C > CE/C Exits the entry of the P/Y variable. 5 >...

- Page 7 $2,500 investment made at the beginning of the year Sequence of entries Display Explanation CE/C > 2ND > CLR TVM Resets the default values. 2ND > BGN > 2ND > Activates the calculation of beginning-of- period payments. 2ND > P/Y > 1 > ENTER P/Y = 1 Enters an annual payment period.

- Page 8 Calculating the payment of a personal or mortgage loan The process of calculating a personal or mortgage loan consists of: Determining the known variables; Entering the number of payment periods (P/Y) and the number of interest-calculation periods (C/Y); Calculating the unknown variable. Sample calculation of a personal loan repayment Mary wants to borrow $15,000 to purchase a new car, and she wants to repay the loan over a five-year period.

- Page 9 Sample calculation of a mortgage loan repayment Claude buys a home for $125,000 and makes a $40,000 cash downpayment. To finance the balance, the bank offers him an $85,000 mortgage loan at a nominal rate of 6% compounded on a semi-annual basis. What monthly payments will be required to repay this mortgage over a 20-year term? What will the mortgage balance be after five years? To answer these two questions, the known variables must first be determined:...

- Page 10 The balance of the mortgage loan after five years is calculated using the following operations, after having computed the monthly payment of $605.36: Sequence of entries Display Explanation Do not change the data already entered for the financial variables 5 > 2ND > xP/Y > N N = 60 Enters the number of monthly payments over a five-year period.

- Page 11 Self-Evaluation Exercise Question 1. You borrow $75,000 to buy a house and agree to repay the loan in 20 years at an interest rate of (6.5%, 2). How much lower would your monthly payment be with a (6%, 2) interest rate a) $555.38 b) $534.15 c) $21.24...

- Page 12 Question 4. What will your mortgage loan balance be after four years if the following conditions apply (round off to the nearest dollar)? Amount of the loan: $110,000 Interest rate: (8%, 2) Term of the loan: 25 years with monthly repayments a) $103,361 b) $93,360 c) $83,953...

- Page 13 Answer Sheet Answer 1. You borrow $75,000 to buy a house and agree to repay the loan in 20 years at an interest rate of (6.5%, 2). How much lower would your monthly payment be with an interest rate of (6%, 2)? a) $555.38 b) $534.15 c) $21.24...

- Page 14 Answer 2. What nominal rate, compounded semi-annually, lets you double your capital in ten years (rounded off)? a) 6% b) 7% c) 8% d) 9% e) 10% The correct answer is b). Reason: Sequence of entries Display Explanation CE/C > 2ND > CLR TVM Resets the default values.

- Page 15 The correct answer is c). Reason: Sequence of entries Display Explanation CE/C > 2ND > CLR TVM Resets the default values. 2ND > P/Y > 1 > ENTER P/Y = 1 Enters an annual payment period. CE/C > CE/C Exits the entry of the C/Y variable. 10 000 >...

- Page 16 The correct answer is a). Reason: Sequence of entries Display Explanation CE/C > 2ND > CLR TVM Resets the default values. 2ND > P/Y > 12 > P/Y = 12 Enters a monthly payment period. ENTER > 2 > ENTER C/Y = 2 Enters a semi-annual interest- calculation period.

- Page 17 Reason: Sequence of entries Display Explanation CE/C > 2ND > CLR TVM Resets the default values. 2ND > P/Y > 12 > ENTER P/Y = 12 Enters a monthly payment period. CE/C > CE/C Exits the entry of the P/Y variable. 7 >...

Need help?

Do you have a question about the BA II Plus and is the answer not in the manual?

Questions and answers