Table of Contents

Advertisement

Advertisement

Table of Contents

Subscribe to Our Youtube Channel

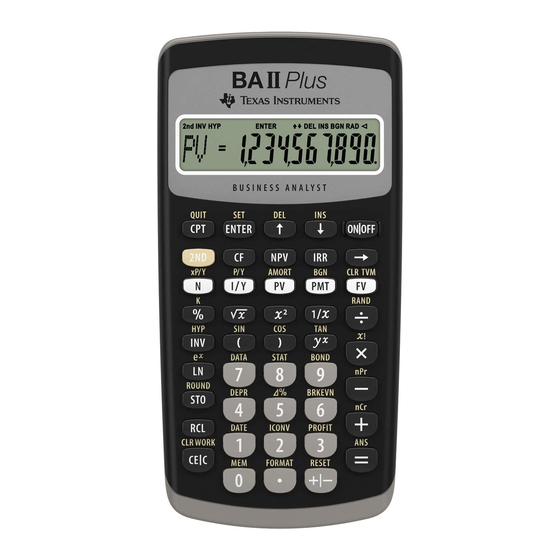

Summary of Contents for Texas Instruments BA II PLUS

- Page 1 BA II PLUS™ Calculator ©1997, 2002 Texas Instruments Incorporated...

- Page 2 “as-is” basis. In no event shall Texas Instruments be liable to anyone for special, collateral, incidental, or consequential damages in connection with or...

-

Page 3: Table Of Contents

1: Overview of Calculator Operations Turning the Calculator On and Off ......Resetting the Calculator ........Keys and 2nd Functions ........The Display ..........Display Indicators ..........Setting Calculator Formats ........Clearing the Calculator ........Correcting Entry Errors ........Math Operations .......... - Page 4 2: Time-Value-of-Money and Amortization Worksheets TVM and Amortization Worksheet Labels ....Time-Line Diagrams ........Procedure: Using the TVM Worksheet ...... Procedure: Generating an Amortization Schedule ..... Procedure: Automatically Generating a Schedule ..... Basic Loan Calculations—Interest ......Basic Loan Calculations—Payments ......Future Value of Savings ........

- Page 5 4: Bond Worksheet Terminology ........... Entering Bond Data and Computing Results ....Bond Price and Accrued Interest Example ....5: Depreciation Worksheet Depreciation Worksheet Labels ......Entering Data and Computing Results ...... Declining Balance with Straight-Line Crossover Example ..Straight-Line Depreciation Example ......

- Page 6 Formulas ..........Error Conditions ........Accuracy Information ........IRR Calculations ........AOSé (Algebraic Operating System) Calculations ..... Battery Information ........In Case of Difficulty ........Texas Instruments (TI) Support and Service Information ..Texas Instruments (TI) Warranty Information ....Index...

-

Page 7: 1: Overview Of Calculator Operations

Overview of Calculator Operations This chapter contains information on: • Basic calculator operation • Clearing and correcting • Math operations • Memory • Last Answer • Worksheets 1: Overview of Calculator Operations... -

Page 8: Turning The Calculator On And Off

Automatic Power Down™ (APD™) Feature To prolong the life of the battery, the Automatic Power Down (APD) feature turns the calculator off automatically if you do not press any key for approximately 10 minutes. BA II PLUS™ Calculator... -

Page 9: Resetting The Calculator

Resetting the Calculator Resetting the calculator restores all default settings and clears all data. Because you can clear only selected portions of data, you should reserve the reset function for appropriate situations. You might choose to reset when you first purchase the calculator or when you start a new project. -

Page 10: Keys And 2Nd Functions

ABC represents the spaces where the three-letter abbreviations for the variable labels are displayed. BA II PLUS™ Calculator... -

Page 11: Display Indicators

Display Indicators Indicator Meaning The calculator will access the second function of the next key pressed. The calculator will access the inverse function of the next key or key sequence pressed. The calculator will access the hyperbolic function of the next key or key sequence pressed. -

Page 12: Setting Calculator Formats

To round the internal value, use the round function. Note: Examples in this guidebook assume a setting of two decimal places. Other settings may show different results. BA II PLUS™ Calculator... - Page 13 Procedure: Changing the Number of Decimal Places ³ Press & |. is displayed with the current DEC= decimal-place setting. · Enter the number of decimal places to be displayed (0 through 9) and press !. To specify a floating-decimal format, enter 9. »...

- Page 14 » Choose one of the following to continue: < To continue setting formats, press # or ". < To return to the standard-calculator mode, press & U . < To access a worksheet, press the appropriate worksheet key or key sequence. BA II PLUS™ Calculator...

- Page 15 Separator Format You can select either the US or the European format for the display of separators in numbers. The default setting for separators is the US format. 1,000.00 US and UK format ( European format ( 1.000,00 Procedure: Changing the Separator Format ³...

- Page 16 » Choose one of the following to continue: < To continue setting formats, press # or ". < To return to the standard-calculator mode, press & U . < To access a worksheet, press the appropriate worksheet key or key sequence. BA II PLUS™ Calculator...

-

Page 17: Clearing The Calculator

Clearing the Calculator To clear . . . Keystrokes . . . one character at a time from the display (including decimal points)..an incorrect entry, an error condition, or an error message from the display..out of a worksheet and return to standard-calculator &... -

Page 18: Correcting Entry Errors

Use * to correct the mistake, and then continue with your calculation. Procedure Keystrokes Display & U Clear the calculator. 0.00 < Begin the expression. 3.00 Enter the second number incorrectly. 1234.86 1,234.86 Erase the 86. 1,234. Complete the number correctly. 1,234.56 Compute the result. 3,703.68 BA II PLUS™ Calculator... -

Page 19: Math Operations

Math Operations When the calculation method is set to chain ( ), mathematical expressions, such as 3 + 2 Q 4, are evaluated in the order that you enter them. The N key completes an operation and displays the result. Operation Example Keystrokes... - Page 20 * The random number generated when you press & a may not be the one shown here. ** Angles are interpreted according to the current setting for angle units (degrees or radians). These examples show angles in degrees. BA II PLUS™ Calculator...

-

Page 21: More On Selected Math Operations

More on Selected Math Operations Universal Power ; lets you raise a positive number to any power (2 (1/3) or 2 , for example). However, you can raise a negative number only to an integer power or the reciprocal of an odd number. In either case, the power can be either positive or negative. - Page 22 You cannot directly enter a number in scientific notation, but when the AOS calculation method is selected, you can use the ; key to enter a number in scientific notation. < For example, for 3 Q 10 , key in BA II PLUS™ Calculator...

-

Page 23: Memory Operations

Memory Operations Your calculator always has 10 memories available. • The memories can hold any numeric value within the range of the calculator. • The memories are numbered through . This lets you access each memory using a single keystroke. Clearing Memory There are two ways to clear memory. - Page 24 Multiply the value in memory 0 by the value in D < the display. Divide the value in memory 5 by the value in the display. Raise the value in memory 4 to the power of the displayed value. BA II PLUS™ Calculator...

-

Page 25: Calculations Using Constants

Calculations Using Constants & ` stores a number and an operation for use in repetitive calculations. After you store the constant, you can use it in subsequent calculations by entering a new value and pressing N. The constant is cleared when you press any key other than a numeric entry key or N. -

Page 26: Last Answer Feature

Procedure Keystrokes Display & U Clear the calculator. 0.00 Enter a calculation and complete it with the equal key. 4.00 Begin a new calculation. 2.00 & x Recall the last answer. 4.00 Complete the calculation. 16.00 BA II PLUS™ Calculator... -

Page 27: Using Worksheets: Tools For Financial Solutions

Using Worksheets: Tools for Financial Solutions What Is a Worksheet? Each worksheet is designed as a framework for a set of variables. The formulas that define the relationships between the variables, though not visible, are built into each worksheet. • Each worksheet is designed to solve specific types of problems such as time-value-of money, cash-flow, bond, or depreciation problems. -

Page 28: Types Of Worksheets

You can enter values using the five basic TVM keys at any time, even when you are in another worksheet. However, to compute TVM values or clear the TVM worksheet, you must be in the standard-calculator mode. To return to the standard-calculator mode, press & U . BA II PLUS™ Calculator... - Page 29 Prompted-worksheet Variables To access the column of variables within a prompted worksheet (or portion of a prompted worksheet), press the appropriate worksheet key or key sequence. For example, to access the amortization variables , and (first payment in a range, last payment in a range, remaining balance, principal, and interest), press &...

- Page 30 • To enter a TVM value, key a value into the display and press the appropriate variable key. • To compute a TVM value, press % and the appropriate variable key. BA II PLUS™ Calculator...

- Page 31 Enter-or-Compute Variables in Prompted Worksheets Some prompted worksheets contain variables that you can either enter or compute. When you access an enter-or-compute variable, the variable label is displayed along with both the indicators. ENTER COMPUTE • The indicator reminds you that if you key in a value ENTER for the variable, you must press ! to assign the value to the variable.

-

Page 32: Clearing Worksheets And Setting Defaults

& ^ & [ & ] & \ Label & z & z & z END / Note: & } ! also sets the calculator formats (2 decimal places, DEG, US dates, US number separators, CHN calculations). BA II PLUS™ Calculator... -

Page 33: 2: Time-Value-Of-Money And Amortization Worksheets

Time-Value-of-Money and Amortization Worksheets The Time-Value-of-Money and Amortization worksheets are useful in applications where the cash flows are equal, evenly spaced, and either all inflows or all outflows. They help you solve problems involving annuities, loans, mortgages, leases, and savings. You can also generate an amortization schedule. Press # and "... -

Page 34: Tvm And Amortization Worksheet Labels

♦ & ] & z sets (not ♦ & \ & z sets , and P1=1 P2=1 BAL=0 PRN=0 INT=0 ♦ When solving a problem using only four of the five TVM variables, make sure the unused variable is zero. BA II PLUS™ Calculator... - Page 35 Notes about TVM and Amortization Worksheets (cont.) ♦ Enter values for , and as negative if they are outflows (cash paid out) or as positive if they are inflows (cash received). To enter a negative value, press S after entering the number. ♦...

- Page 36 By entering the number of years (for example, 30) and pressing & Z, you can compute the number of payments required to pay off an annuity. Press , to enter that value as the number of payments in a TVM calculation. BA II PLUS™ Calculator...

- Page 37 Compound Interest Many lending institutions add the interest you earn to the principal. The interest you earn from the previous compounding period becomes part of the principal for the next compounding period. Compound interest enables you to earn a greater amount of interest on your initial investment.

-

Page 38: Time-Line Diagrams

(cash received) as positive and outflows of cash (cash paid out) as negative. • You must enter inflows as positive values and outflows as negative values. • The calculator displays computed inflows as positive values and computed outflows as negative values. BA II PLUS™ Calculator... -

Page 39: Procedure: Using The Tvm Worksheet

Procedure: Using the TVM Worksheet The worksheet stores the values and settings you enter until you clear the worksheet or change the values or settings. Therefore, you may not need to do all the steps in the procedure every time you work a TVM problem. ³... -

Page 40: Procedure: Generating An Amortization Schedule

— the interest paid over the specified range ´ Press & \ or, if is displayed, press # to display again. ² Repeat steps 2 and 3 for each range of payments to generate an amortization schedule. BA II PLUS™ Calculator... -

Page 41: Procedure: Automatically Generating A Schedule

Procedure: Automatically Generating a Schedule After you enter the initial values for , as described above, you can automatically compute an amortization schedule. ³ Press & \ or, if is displayed, press # to display and its current value. · Press %. This automatically updates both represent the next range of payments. -

Page 42: Basic Loan Calculations-Interest

Set all variables to defaults. 0.00 Enter number of payments & Z , using payment multiplier. 360.00 Enter loan amount. 75000 75,000.00 Enter payment amount. 576.69 PMT= -576.69 Compute interest rate. I/Y= 8.50 The interest rate is 8.5% per year. BA II PLUS™ Calculator... -

Page 43: Basic Loan Calculations-Payments

Basic Loan Calculations—Payments Example: Monthly Payment You are considering a 30-year mortgage at 8.5% for $75,000. How much would the monthly payment be? Procedure Keystrokes Display & } ! Set all variables to defaults. 0.00 Enter number of payments & Z , using payment multiplier. -

Page 44: Future Value Of Savings

Set payments per year to 1. P/Y= 1.00 & U Return to calculator mode. 0.00 Enter number of payments. 20.00 Enter interest rate. I/Y= 5.00 Enter beginning balance. 5000 -5,000.00 Compute future value. 13,266.49 The future value is $13,266.49. BA II PLUS™ Calculator... -

Page 45: Present Value Of Savings

Present Value of Savings Example: Future Value of Savings You are opening a savings account that you want to be worth $10,000 in 20 years. The bank pays 5%, compounded at the end of each year. How much do you need to deposit now? Procedure Keystrokes Display... -

Page 46: Present Value In Present-Value Annuities

$20,000 . . . N = 10 I/Y = 10 • For a present value annuity due for a leasing agreement: PV = ? $20,000 $20,000 $20,000 . . . N = 10 I/Y = 10 BA II PLUS™ Calculator... - Page 47 Example: Present Value of Cost Savings (cont.) Procedure Keystrokes Display & } ! Set all variables to defaults. 0.00 & [ Set payments per year to 1. P/Y= 1.00 & U Return to calculator mode. 0.00 Enter number of payments. 10.00 Enter interest rate per payment period.

-

Page 48: Perpetual Annuities

• For a perpetual ordinary annuity: PV = ( I/Y / 100) • For a perpetual annuity due: PV = PMT + ( I/Y / 100) BA II PLUS™ Calculator... - Page 49 Example: Present Value of Perpetual Annuities The Land of OZ has issued perpetual bonds for replacing bricks in their highway system. The bonds pay $110 per $1000 bond. You plan to purchase the bonds if you can earn 15% annually. What price should you pay for the bonds? Procedure Keystrokes...

-

Page 50: Variable Cash Flows

Year Amount $5000 $7000 $8000 $10000 Assuming a discount rate of 10%, does the present value of the cash flows exceed the original cost of $23,000? PV = ? $5,000 $7,000 $8,000 $10,000 BA II PLUS™ Calculator... - Page 51 Example: Present Value of Annual Savings Procedure Keystrokes Display & } ! Set all variables to defaults. 0.00 & [ Set payments per year to 1. P/Y= 1.00 & U Return to calculator mode. 0.00 Enter interest rate per cash flow period.

-

Page 52: Lease-Or-Buy Decision

137,568.16… The present value of the annual savings exceeds the purchase price (i.e., the investment will exceed your annual required return rate). Acquiring the server is a good financial move. Should you lease or buy it? BA II PLUS™ Calculator... - Page 53 Example: Present Value of Lease Payments Procedure Keystrokes Display & } ! Set all variables to defaults. 0.00 & [ Set payments per year to 1. P/Y= 1.00 & ] Set beginning-of-period & V payments. & U Return to calculator mode. 0.00 Enter number of periods.

-

Page 54: Present Value Of Lease With Residual Value

Enter residual value of asset. 6500 -6,500.00 Compute present value of residual. 2,818.22 Enter amount of lease payment. 1200 PMT= -1,200.00 Compute present value of lease payments. 40,573.18 Peach Bright should pay your company $40,573.18 for the machine. BA II PLUS™ Calculator... -

Page 55: Monthly Payments

Monthly Payments You are planning to purchase a new small desk and chair set that is sale priced at $525. You can finance your purchase at 20% APR, compounded monthly, for two years. How much is the monthly payment? PV = $525 FV = $0 PMT = ? PMT = ? -

Page 56: Yield To Maturity On Bond Purchased On Interest Date

Recall rate from memory. NOM= 12.37 Enter compounding periods. C/Y= 2.00 Compute annual effective rate. " % EFF= 12.75 The annual yield to maturity is 12.37% with semiannual compounding. The equivalent annual effective rate is 12.75%. BA II PLUS™ Calculator... -

Page 57: Saving For The Future By Making Monthly Deposits

Saving for the Future by Making Monthly Deposits Accounts with payments made at the beginning of the period are referred to as “annuity due” accounts. Interest on annuity due accounts starts accumulating earlier and produces slightly higher yields. An individual has decided to invest $200 at the beginning of each month in a retirement plan. -

Page 58: Amount To Borrow And Down Payment

48.00 Enter monthly interest rate. 13.51 I/Y= 13.51 Enter payment. PMT= -125.00 Compute loan amount. 4,615.73 Calculate down payment. 5100 -484.27 To buy the car, you can borrow $4,615.73 and make a down payment of $484.27. BA II PLUS™ Calculator... -

Page 59: Regular Deposits For A Specified Future Amount

Regular Deposits for a Specified Future Amount You plan to open a savings account and deposit the same amount of money at the beginning of each month. In 10 years, you want to have $25,000 in the account. How much should you deposit if the annual interest rate is 7% with quarterly compounding? (compounding periods per year) is automatically set to... -

Page 60: Time Value Of Money/Amortization Schedule

To see the stored value of displayed with three digits, press & | ! & U J The computed monthly payment is $976.36. Because money paid out, it is displayed as a negative number. BA II PLUS™ Calculator... - Page 61 Example: Loan Amortization (continued from previous example) Use the Amortization worksheet to generate an amortization schedule for the first three years of the loan. Assume that the first payment is in April; therefore, the first year has 9 payment periods. There are 12 payment periods per year thereafter. Procedure Keystrokes Display...

-

Page 62: Interest And Loan Balance After Specified Payment

View computed interest paid after five years. INT= -40,367.43 If the seller financed the sale, he would receive: • $719.61 each month for five years. • $40,367.43 in interest over the five-year term. • $79,190.83 as the balloon payment. BA II PLUS™ Calculator... -

Page 63: Canadian Mortgages

Canadian Mortgages Canadian mortgages typically require the borrower to make monthly payments, although interest is compounded semiannually. Additionally, mortgages are usually refinanced at the end of a fixed period of time, such as five years. A home buyer borrows $60,000 for 20 years at an annual interest rate of 13 % compounded semiannually. - Page 64 BA II PLUS™ Calculator...

-

Page 65: 3: Cash Flow Worksheet

Cash Flow Worksheet Three keys are used for performing cash-flow calculations. lets you enter cash flow data. lets you compute net present value. lets you compute internal rate of return. Press # and " to move through each set of variables. 3: Cash Flow Worksheet... -

Page 66: Cash Flow Worksheet Labels

(cash paid out) as negative. Use S to enter a negative value. ♦ The indicators in the display let you know that you can use & X and & W to insert or delete cash flows. BA II PLUS™ Calculator... -

Page 67: Interpreting The Results Of Irr Calculations

Interpreting the Results of IRR Calculations When you compute a value for (internal rate of return), the calculator displays either a solution or an error message. When a solution is displayed, there are two possibilities. • The displayed solution is the only solution. •... -

Page 68: Uneven And Grouped Cash Flows

In other cash-flow problems, there may be consecutive cash flows of equal value. You must enter unequal cash flows separately, but you can save time and space by using the nn variable to enter groups of consecutive cash flows of equal value. BA II PLUS™ Calculator... -

Page 69: Entering Cash Flows

Entering Cash Flows You can enter the initial cash flow and up to 24 additional cash flows, each of which can be a unique value. Enter inflows as positive and outflows as negative. If you have consecutive cash flows of equal value, you can enter the cash-flow value and then a frequency of up to 9,999 for the number of times the value occurs. -

Page 70: Deleting Cash Flows

³ Press # or " until the cash flow you want to delete is displayed. · Press & W. The cash flow you specified (and its frequency) is deleted. The calculator decreases the numbers of subsequent cash flows so that there is no gap. BA II PLUS™ Calculator... -

Page 71: Inserting Cash Flows

Inserting Cash Flows When you insert a cash flow, the calculator increases the numbers of the current and subsequent cash flows. When inserting cash flows, remember that the most cash flows you can enter is 24. Procedure: Inserting a Cash Flow indicator lets you know when you can insert a cash flow. -

Page 72: Computing Npv And Irr

The calculator computes and displays the value. Procedure: Computing Internal Rate of Return ³ Press ). and its current value are displayed. IRR= · Press % to compute the internal rate of return. The calculator computes and displays the value. BA II PLUS™ Calculator... -

Page 73: Uneven Cash Flows

Uneven Cash Flows A company plans to pay $7,000 for a new machine. The company would like a 20% annual return on its investment. Over the next six years, the company expects to receive the annual cash flows shown below. Year Cash Flow Number Cash Flow Estimate... - Page 74 Delete third cash flow. C03= 0.00 " " Move to second cash flow. C02= 5,000.00 & X Insert new second cash flow. 4000 C02= 4,000.00 F02= 1.00 Move to next cash flow to verify C03= 5,000.00 data. F03= 4.00 BA II PLUS™ Calculator...

- Page 75 Example: Computing Net Present Value (continued from previous example) Compute the net present value ( ) using an interest rate per period ( ) of 20%. Procedure Keystrokes Display Access 0.00 Enter interest rate per period. 20.00 Compute net present value. NPV= 7,266.44 Example: Computing Internal Rate of Return...

-

Page 76: Value Of A Lease With Uneven Payments

• What even payment amount at the beginning of each month would result in the same present value? Because the cash flows are uneven, use the Cash Flow worksheet to determine the net present value ( ) of the lease. BA II PLUS™ Calculator... - Page 77 Example: Compute Net Present Value of Cash Flows The cash flows for the first four months are stated as a group of four $0 cash flows. Because the lease specifies beginning-of- period payments, you must treat the first cash flow in this group as the initial investment ( ) and enter the remaining three cash flows on the cash flow screens (...

- Page 78 Enter number of payments. 36.00 Compute payment. PMT= -4,418.90 At the required earnings rate of 10%, the present value of the lease payments is $138,088.44. An even monthly payment of $4,418.90 would result in the same present value. BA II PLUS™ Calculator...

-

Page 79: 4: Bond Worksheet

Bond Worksheet To access the Bond worksheet, press & l. Press # and " to move through each set of variables. 4: Bond Worksheet... - Page 80 ♦ You can enter dates from January 1, 1950, through December 31, 2049. ♦ When you enter a value for , remember that it is the annual coupon rate as a percent—not the dollar amount of the coupon payment. BA II PLUS™ Calculator...

- Page 81 Notes about the Bond Worksheet (cont.) ♦ Enter a date for (redemption date) in the date format you selected (U.S. or European). The calculator assumes that the redemption date ( ) coincides with a coupon date. < For “to maturity” calculations, enter the maturity date for <...

-

Page 82: Terminology

The yield to maturity takes into account the amount of premium or discount, if any, and the time value of the investment. BA II PLUS™ Calculator... -

Page 83: Entering Bond Data And Computing Results

Entering Bond Data and Computing Results Before computing values for price or yield and accrued interest, enter the four known values (settlement date, coupon rate, redemption date, and redemption value). If necessary, change the day-count method and coupon frequency settings. The worksheet stores values and settings until you clear the worksheet or change the values and settings. - Page 84 Computing Accrued Interest (AI) A value for (accrued interest) is computed and displayed automatically when you access the variable. is computed in terms of dollars per $100 of par value. Press # repeatedly until and its value are displayed. BA II PLUS™ Calculator...

-

Page 85: Bond Price And Accrued Interest Example

Bond Price and Accrued Interest Example You want to purchase a semiannual corporate bond that matures on 12/31/97 to settle on 6/12/96. The bond is based on the 30/360 day-count method with a coupon rate of 7%. It will be redeemed at 100% of its par value. - Page 86 BA II PLUS™ Calculator...

-

Page 87: 5: Depreciation Worksheet

Depreciation Worksheet To access the Depreciation worksheet, press & p. Then choose a depreciation method, enter the known values, and compute the unknown values. To choose a depreciation method, press & V repeatedly until the desired method is displayed. Press # and " to move through each set of variables. 5: Depreciation Worksheet... -

Page 88: Depreciation Worksheet Labels

European format for entering dates or entering separators in numbers. (initial date) is available only for ♦ , and are computed a year at a time. Results are rounded to the number of decimal places specified by the display format. BA II PLUS™ Calculator... - Page 89 Notes about the Depreciation Worksheet (cont.) ♦ Values for , and are computed and displayed automatically when you press # to display each variable. ♦ If you choose as the depreciation method, enter a value for declining-balance percent when you display the label.

-

Page 90: Entering Data And Computing Results

To generate a depreciation schedule and compute values for other years: ³ Press # to display the variable, and then press % to increment the value by one. · Press # repeatedly to automatically compute and display new values for , and BA II PLUS™ Calculator... -

Page 91: Declining Balance With Straight-Line Crossover Example

Declining Balance with Straight-Line Crossover Example In mid-May, a company begins to depreciate a machine with a seven-year life and no salvage value. The machine cost is $100,000. Use the declining-balance with straight-line crossover method to compute the depreciation expense, remaining book value, and remaining depreciable value for the first two years. -

Page 92: Straight-Line Depreciation Example

For the first year, the depreciation amount is $25,132.28, the remaining book value is $974,867.72, and the remaining depreciable value is $974,867.72. For the second year, the depreciation amount is $31,746.03, the remaining book value is $943,121.69, and the remaining depreciable value is $943,121.69. BA II PLUS™ Calculator... -

Page 93: 6: Statistics Worksheet

Statistics Worksheet Two keys are used for performing statistics calculations. & j lets you enter statistical data. & k lets you choose a statistics calculation method and compute results. Press # and " to move through each set of variables. 6: Statistics Worksheet... -

Page 94: Statistics Worksheet Labels

Sum of X squared values Auto-compute Sum of Y values Auto-compute Sum of Y squared values Auto-compute Sum of XY products Auto-compute * nn indicates the number of the current value. ** Not displayed for one-variable statistics. BA II PLUS™ Calculator... - Page 95 Notes about the Statistics Worksheet & j & z sets all values and all values in the Stat portion of the worksheet to zero, but does not affect the statistics calculation method. & k & z sets the statistics calculation method to and all values to zero.

-

Page 96: Regression Models

(the correlation coefficient) which measures the goodness of fit of the equation with the data. is to 1 or -1, the better the fit; the closer In general, the closer is to zero, the worse the fit. BA II PLUS™ Calculator... -

Page 97: Entering Statistical Data

Entering Statistical Data & j lets you enter and display up to 50 data points. The Statistics worksheet stores the values you enter until you clear the worksheet or change the values. Therefore, you may not need to do all the steps each time you perform a Statistics calculation. -

Page 98: Editing Statistical Data

“above” the current data point. The calculator increases the numbers of the current and subsequent data points. For example, becomes ¿ If necessary, press #, and then key in a value for the variable and press !. BA II PLUS™ Calculator... -

Page 99: Computing Statistical Results

Computing Statistical Results Procedure: Selecting a Statistics Calculation Method ³ Press & k to select the statistical calculation portion of the Statistics worksheet. The most recently selected statistics calculation method is displayed ( , or · Press & V repeatedly until the statistics calculation method you want is displayed. - Page 100 ³ If necessary, press & k. · Press " or # until is displayed. » Key in a value for and press !. ¿ Press " to display the variable. ´ Press % to compute an value. BA II PLUS™ Calculator...

-

Page 101: One-Variable Statistics Example

One-Variable Statistics Example You randomly select a sample of 10 stores to see how much they charge for a particular item. You find the following prices: $63, $69, $71, $69, $74, $74, $72, $66, $74, $76 Note that $69 occurs twice and $74 occurs three times. You can save time entering by using the frequency factor ( nn) for them. -

Page 102: Two-Variable Statistics Example

• Predict the amount of sales ( ) if the company establishes a new office with 10 salespeople. • Determine the number of salespeople needed ( ) to produce $115,000 in monthly sales. BA II PLUS™ Calculator... - Page 103 Example: Entering Two-Variable Statistical Data Procedure Keystrokes Display Select and clear data-entry & j portion of Statistics & z worksheet. 0.00 Enter data set. X01= 7.00 99000 Y01= 99,000.00 X02= 12.00 152000 Y02= 152,000.00 X03= 4.00 81000 Y03= 81,000.00 X04= 5.00 98000 Y04=...

- Page 104 Y = 47,115.38 + 8,423.08 × X The analysis indicates that 10 salespeople would produce approximately $131,346.15 in sales per month. To produce $115,000 in sales per month, you would need approximately eight salespeople. BA II PLUS™ Calculator...

-

Page 105: 7: Other Worksheets

Other Worksheets This chapter contains information about six worksheets: • Percent Change/Compound Interest Worksheet • Interest Conversion Worksheet • Date Worksheet • Profit Margin Worksheet • Breakeven Worksheet • Memory Worksheet 7: Other Worksheets... -

Page 106: Percent Change/Compound Interest Worksheet

= number of periods ♦ For cost-sell-markup calculations, enter values for two of the three variables ( , and ) and compute a value for the unknown. < = cost < = selling price < = percent markup < BA II PLUS™ Calculator... - Page 107 Procedure: Computing Percent Change, Compound Interest, or Cost-Sell-Markup ³ Press & q to select the worksheet. is displayed, along with the previous value. · Press & z to clear the worksheet. » Enter the known values. Do not enter a value for the variable you wish to solve for.

- Page 108 & z worksheet. OLD= 0.00 Enter stock purchase price. OLD= 500.00 Enter stock selling price. NEW= 750.00 Enter number of years. #PD= 5.00 Compute annual growth rate. " % %CH= 8.45 The annual growth rate is 8.45%. BA II PLUS™ Calculator...

- Page 109 Example: Cost-Sell-Markup The original cost of an item is $100; the selling price is $125. Find the markup. Procedure Keystrokes Display Select and clear Percent & q Change/Compound Interest & z worksheet. OLD= 0.00 Enter original cost. OLD= 100.00 Enter selling price. NEW= 125.00 Compute percent markup.

-

Page 110: Interest Conversion Worksheet

♦ & } ! sets to zero, and to 12. ♦ You can convert a nominal rate to an annual effective rate, or vice versa. ♦ Enter a value for as an annual rate. BA II PLUS™ Calculator... - Page 111 Procedure: Converting Interest ³ Press & v to select the worksheet. is displayed, along with the previous value. · Press & z to clear the worksheet. » Enter a value for the known interest rate, either To enter a value for a known variable, press # or " until the variable label you want ( ) is displayed, and then key in a value and press !.

-

Page 112: Date Worksheet

< If you select as the day-count method, the calculator assumes 30 days per month (360 days per year). You can compute using this day-count method, but not BA II PLUS™ Calculator... - Page 113 Procedure: Computing Dates ³ Press & u to select the worksheet. is displayed, along with the previous date. · Press & z to clear the worksheet. » Enter values for two of the three variables: , and . Do not enter a value for the variable you wish to solve for.

-

Page 114: Profit Margin Worksheet

Compound Interest worksheet. ♦ & z sets , and to zero. ♦ & } ! sets , and to zero. ♦ Enter values for two of the variables, and then compute a value for the third variable. BA II PLUS™ Calculator... - Page 115 Procedure: Profit Margin Calculations ³ Press & w to select the worksheet. is displayed, along with the previous value. · If necessary, press & z to clear the worksheet. » Enter values for two of the three variables; for example, enter values for Press # or "...

-

Page 116: Breakeven Worksheet

, and FC=0 VC=0 PFT=0 ♦ Enter values for any four of the five variables, and then compute a value for the fifth variable. ♦ To solve for (the breakeven quantity), enter a value of zero (profit). BA II PLUS™ Calculator... - Page 117 Procedure: Computing Breakeven ³ Press & r to select the worksheet. is displayed, along with the previous value. · If necessary, press & z to clear the worksheet. » Enter values for four of the five variables; for example, enter values for , and Press # or "...

-

Page 118: Memory Worksheet

J, and the digit keys as described in Chapter 1. However, by selecting the Memory worksheet, you can easily review the 10 memories by pressing # and ". ♦ To clear all of the memories at once, press & { & BA II PLUS™ Calculator... - Page 119 Procedure: Using the Memory Worksheet ³ Press & { to select the worksheet. is displayed, along with any value you may have stored in this memory. · Perform any of the following operations. < To clear all 10 memories at once, press & z. <...

- Page 120 · Press 6 Procedure: Raising a Value in Memory to a Power To raise the value in memory 7 to the 66th power. ³ Press # or " until is displayed. · Press ; BA II PLUS™ Calculator...

-

Page 121: Appendix: Reference Information

APPENDIX Reference Information This appendix provides supplemental information on formulas, error conditions, and accuracy that may be helpful as you use your calculator. • Formulas • Error Conditions • Accuracy Information • IRR (Internal-Rate-of-Return) Calculations • Algebraic Operating System (AOS™) •... -

Page 122: Formulas

= 0 for end-of-period payments k = 1 for beginning-of-period payments × − × × × i ƒ 0 where: N = L(PV + FV) P PMT where: i = 0 BA II PLUS™ Calculator... - Page 123 − × − i ƒ 0 where: PMT = L(PV + FV) P N where: i = 0 × × PMT G PMT G − × − i ƒ 0 where: PV = L(FV + PMT Q N) where:...

- Page 124 M = number of coupon periods per year standard for the particular security involved (set to 1 or 2 in Bond worksheet) DSR = number of days from settlement date to redemption date (maturity date, call date, put date, etc.) BA II PLUS™ Calculator...

- Page 125 E = number of days in coupon period in which the settlement date falls Y = annual yield (as a decimal) on investment with security held to redemption (YLD P 100) A = number of days from beginning of coupon period to settlement date (accrued days) Note: The first term computes present value of the redemption amount, including interest, based on the yield for the invested period.

- Page 126 Values for DEP, RDV, CST, and SAL are rounded to the number of decimals you choose to be displayed. In the following formulas, FSTYR = (13 N MO1) P 12. Straight-line depreciation − − × First year: FSTYR Last year or more: DEP = RDV BA II PLUS™ Calculator...

- Page 127 Sum-of-the-years’-digits depreciation + − − × − YR FSTYR × ÷ × − × First year: FSTYR × ÷ Last year or more: DEP = RDV Declining-balance depreciation × × where: RBV is for YR - 1 × × First year: FSTYR ×...

- Page 128 where: OLD = old value NEW = new value %CH = percent change #PD = number of periods Profit Margin − Selling Price Cost × Gross Profit Margin Selling Price BA II PLUS™ Calculator...

- Page 129 Breakeven PFT = P Q N (FC + VC Q) where: PFT = profit P = price FC = fixed cost VC = variable cost Q = quantity Days between Dates With the Date worksheet, you can enter or compute a date within the range January 1, 1950, through December 31, 2049.

- Page 130 Note: If DT1 is 31, change DT1 to 30. If DT2 is 31 and DT1 is 30 or 31, change DT2 to 30; otherwise, leave it at 31. Source for 30/360 day-count method formula: Lynch, John J., Jr., and Jan H. Mayle. Standard Securities Calculation Methods. New York: Securities Industry Association, 1986. BA II PLUS™ Calculator...

-

Page 131: Error Conditions

Error Conditions The calculator reports error conditions by displaying the message , where is the number of the error. Error messages are listed in Error n numerical order on the next few pages. Use this table to determine the cause of the error. You cannot make any keyboard entries until you clear an error condition by pressing P. - Page 132 Iteration limit complex problem involving many iterations. exceeded In Cash Flow worksheet, attempted to compute for a complex problem with multiple sign changes. In Bond worksheet, attempted to compute for a very complex problem. BA II PLUS™ Calculator...

- Page 133 Error Possible Causes In TVM worksheet, pressed $ to stop the evaluation Error 8 Canceled iterative calculation In Amortization worksheet, pressed $ to stop the evaluation of In Cash Flow worksheet, pressed $ to stop the evaluation of In Bond worksheet, pressed $ to stop the evaluation In Depreciation worksheet, pressed $ to stop the evaluation of Appendix: Reference Information...

-

Page 134: Accuracy Information

However, higher-order mathematical functions use iterative calculations, and inaccuracies can accumulate in the guard digits. In most cases, the cumulative error from these calculations is maintained beyond the 10-digit display so that no inaccuracy is shown. BA II PLUS™ Calculator... -

Page 135: Irr Calculations

IRR Calculations When you solve for , the calculator performs a series of complex, iterative calculations. An problem may have one solution, multiple solutions, or no solution. The number of possible solutions depends on the number of sign changes in your cash-flow sequence. - Page 136 When Solving a Complex Problem When you are solving very complex cash-flow problems, the calculator may not be able to find even if a solution exists. When this is the case, the calculator displays (iteration Error 7 limit exceeded). BA II PLUS™ Calculator...

-

Page 137: Aosé (Algebraic Operating System) Calculations

AOS™ (Algebraic Operating System) Calculations If you select (rather than ) as the calculation method, the calculator uses the standard rules of algebraic hierarchy to determine the order in which operations are performed. Algebraic Hierarchy The table below shows the order in which operations are performed when is selected as the calculation method. -

Page 138: Battery Information

♦ Do not mix rechargeable and nonrechargeable batteries. ♦ Install batteries according to polarity (+ and –) diagrams. ♦ Do not place nonrechargeable batteries in a battery recharger. ♦ Properly dispose of used batteries immediately. ♦ Do not incinerate or dismantle batteries. BA II PLUS™ Calculator... -

Page 139: In Case Of Difficulty

In Case of Difficulty If you have difficulty operating the calculator, you may be able to correct the problem without returning the calculator for service. This table lists several problems and possible solutions. Difficulty Solution The calculator Check the settings of the current worksheet to computes wrong make sure they are right for the problem you answers. -

Page 140: Texas Instruments (Ti) Support And Service Information

Customers in the U.S., Canada, Mexico, Puerto Rico and Virgin Islands: Always contact Texas Instruments Customer Support before returning a product for service. All other customers: Refer to the leaflet enclosed with this product (hardware) or contact your local Texas Instruments retailer/distributor. BA II PLUS™ Calculator... -

Page 141: Texas Instruments (Ti) Warranty Information

(at TI’s option) when the product is returned, postage prepaid, to Texas Instruments Service Facility. The warranty of the repaired or replacement unit will continue for the warranty of the original unit or six (6) months, whichever is longer. - Page 142 Australia & New Zealand Customers only One-Year Limited Warranty for Commercial Electronic Product This Texas Instruments electronic product warranty extends only to the original purchaser and user of the product. Warranty Duration. This Texas Instruments electronic product is warranted to the original purchaser for a period of one (1) year from the original purchase date.

-

Page 143: Index

Index x (mean of X), 88, 89 Actual/actual day-count method (ACT), y (mean of Y), 88 74, 75, 77, 106, 107 . (negative), 5 Addition, 13 P indicator, 5 AI (accrued interest), 74, 75, 78, 79 #$ indicator, 5 Algebraic Operating System (AOS™) #PD (number of periods), 100, 101, 102 calculations, 6, 10, 131 σx (population standard deviation of X),... - Page 144 Correlation coefficient (r), 88, 90, 96, 97 in case of difficulty, 133 Cosine, 14 listing, 125–27 Cost (CST), 82, 84, 108, 109 Cost-Sell-Markup, 101, 103 (date format), 8, 106 Coupon payment, 76 (number separator format), 9 BA II PLUS™ Calculator...

- Page 145 Examples —F— accrued interest, 79 Face value, 76 accumulated interest and loan Factorial, 14, 15 balance, 56 FC (fixed cost), 110, 111 amortization, 55 Fixed cost (FC), 110, 111 amortization schedule, 50, 54, 55, Floating-decimal format, 6, 7 56, 57 Fnn (frequency of nth cash flow), 60 annual savings, 44 Forecasting, 90...

- Page 146 Population standard deviation of X (σx), recalling from, 17 88, 89 storing to, 17 Population standard deviation of Y (σy), Memory worksheet, 112–14 Mortgages, 27 Power regression (PWR), 88, 89, 90 Multiplication, 13 Predicted X value (X'), 88, 89, 94 BA II PLUS™ Calculator...

- Page 147 Predicted Y value (Y'), 88, 89, 93 —Q— Premium bond, 76 Q (quantity), 110, 111 Present value (PV), 28, 29, 30 Quantity (Q), 110, 111 PRI (dollar price), 74, 75, 76, 78, 79 Principal paid (PRN), 28, 29 —R— PRN (principal paid), 28, 29 r (correlation coefficient), 88, 90, 96, 97 Procedures RAD (radians), 5, 7...

- Page 148 (date format), 8, 106 YLD (yield to redemption), 74, 75, 78 (number separator format), 9 Ynn (frequency of X value), 88, 89 YR (year to compute), 82, 83, 84 —V— Variable cost per unit (VC), 110, 111 BA II PLUS™ Calculator...

Need help?

Do you have a question about the BA II PLUS and is the answer not in the manual?

Questions and answers