Advertisement

Quick Links

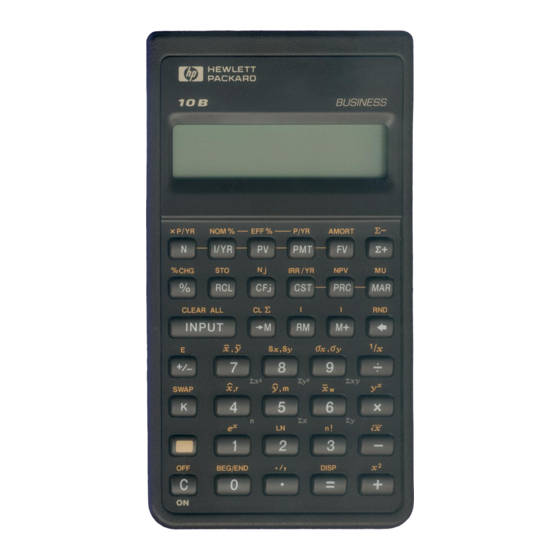

Hewlett-Packard 10B Tutorial

To begin, look at the face of the calculator. Every key (except one, the gold shift key) on the 10B has two

functions: each key's primary function is noted in white on the key itself, while each key's secondary

function is noted in gold above the key. To use the function on the key, simply press the key. To access

the gold function above each key, first press the key with the solid gold face, which we will call the "gold

shift" key, and then press the desired function key. (Note that the gold shift key is near the lower left corner

of the calculator keyboard.)

Turning the Calculator On and Off

C

To turn on the calculator, press

.

Note that the ON key is on the lower left corner of the keyboard—the face of the key has a white "C,"

while the word "ON" appears below the key. Also, we will designate keys throughout this tutorial by the

use of small boxes, as above. To conserve the battery, the calculator turns itself off about 10 minutes after

your last keystroke.

OFF

To turn the calculator off, press

.

Here we are using the solid black square to represent the gold shift key. Thus, the keystrokes to turn the

calculator off are (1) press the gold shift key, and (2) then press the C key. Note that the word "OFF"

appears above the C key in gold. Thus, by pressing the gold shift key first, we are activating the gold

function above the C key, which is the off function. Also, note that pressing the gold shift key places a little

"up arrow" symbol in the lower left corner of the display. Press the gold shift key again and the symbol

goes away. The

key is a toggle key that switches back and forth between the "regular" and the "gold"

functions.

is like the typewriter shift key. After you press

, look only at gold writing. In this tutorial,

whenever you see

, the label on the next key is the gold label above the key, not the label on the key

itself.

Note that the calculator has a continuous memory, so turning it off does not affect any data stored in the

calculator.

Clearing the Calculator

CLEAR ALL

To clear the calculator's memory, press

.

Advertisement

Summary of Contents for HP 10B

- Page 1 Hewlett-Packard 10B Tutorial To begin, look at the face of the calculator. Every key (except one, the gold shift key) on the 10B has two functions: each key's primary function is noted in white on the key itself, while each key's secondary function is noted in gold above the key.

-

Page 2: Changing The Display

Hewlett-Packard 10B Tutorial Page 2 If we did not press , we would input the data shown on the screen to memory. Clearing the calculator is very important, since unwanted data in memory can result in improper calculations, and hence wrong answers. - Page 3 Hewlett-Packard 10B Tutorial Page 3...

-

Page 4: Time Value Of Money (Tvm)

Hewlett-Packard 10B Tutorial Page 4 Periods per Year Setting One important setting that can cause problems is the periods per year setting. To check the current setting, CLEAR ALL press and then press and hold down . The display shows the setting for periods/year. - Page 5 FV of -$200.04 is displayed. The HP is programmed so that if the PV is + then the FV is displayed as - and vice versa, because the HP assumes that one is an inflow and the other is an outflow. When entering both PV and FV, one must be entered as negative and the other as positive.

- Page 6 HP calculates the rate of return to be 12.18 percent. Remember that the HP is programmed so that if the PV is + then the FV is displayed as - and vice versa because the HP assumes that one is an inflow and other is an outflow. When entering both PV and FV values, one must be negative and one positive.

- Page 7 In essence, each payment is shifted back one period. To analyze annuities due press BEG/END . The word “begin” appears on the screen. Now the HP analyzes the cash flows based on BEG/END beginning of period payments. Change back to end mode by pressing Interest Conversion The following equation is used to convert a nominal rate to an effective rate.

- Page 8 The CFs from the time line are entered. Now enter the interest rate. I/YR At this point the HP knows the cash flows, the number of periods, and the interest rate. To find the PV, press to get PV = NPV = $377.40.

- Page 9 Hewlett-Packard 10B Tutorial Page 9 What’s the PV? Clear, set P/YR = 1 if changed. Now the HP knows the cash flows. Thus, enter the interest rate: I/YR Now press to get PV = NPV = $1,099.94. To check your entries: 0 to see CF to see first CF entry.

- Page 10 The NPV of $220.50 is displayed. Thus, the PV of the cash inflows exceeds the cost of the investment by $220.50. If a negative CF occurs at the end of a project’s life, then the HP may give an error message, indicating that IRR/YR there are two IRRs.

-

Page 11: Statistical Calculations

Linear Regression Beta coefficients can be calculated by using the HP’s linear regression capabilities. The X (independent variable) and Y (dependent variable) values must be entered in the proper sequence, where the X data is on the horizontal axis (market) and Y data is on the vertical axis (stock). - Page 12 Hewlett-Packard 10B Tutorial Page 12 30.6 40.1...

- Page 13 The value displayed, 1.60, is the slope coefficient, or the beta coefficient. Amortization The HP can also be used to calculate amortization schedules. Example: Determine the interest and principal paid each year and the balance at the end of each year on a three-year $1,000 amortizing loan which carries an interest rate of 10 percent.

- Page 14 Hewlett-Packard 10B Tutorial Page 14 Beg. Bal. Payment Interest Princ. Repmt. Ending Bal. 1,000.00 402.11 100.00 302.11 697.89 697.89 402.11 69.79 332.32 365.57 365.57 402.11 36.56 365.55 With the data still entered in the TVM menu, do the following: INPUT AMORT “PEr 1-1"...

- Page 15 Hewlett-Packard 10B Tutorial Page 15 Next, with the data still in the calculator, do the following: INPUT AMORT “PEr 1-3" is displayed. Hold down to see Int, then release and -206.35 displayed. This is the total interest paid over Years 1 to 3.