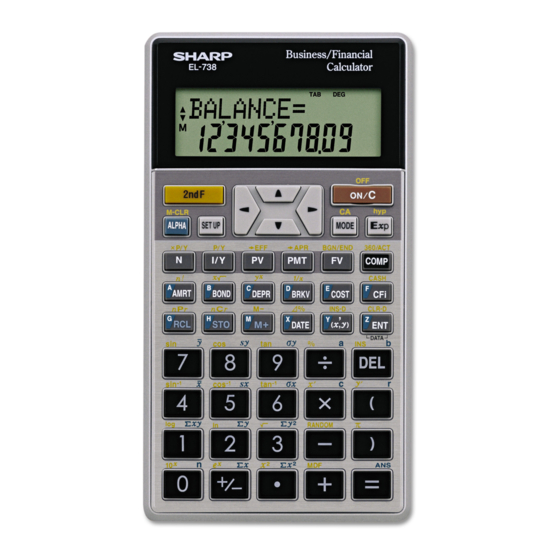

Sharp EL-738 Operation Manual

Business/financial calculator

Hide thumbs

Also See for EL-738:

- Operation manual (88 pages) ,

- Notes (28 pages) ,

- Operation manual (88 pages)

Table of Contents

Advertisement

Advertisement

Table of Contents

Summary of Contents for Sharp EL-738

- Page 1 MODEL EL-738 BUSINESS/FINANCIAL CALCULATOR OPERATION MANUAL...

- Page 2 • SHARP will not be liable nor responsible for any incidental or consequential economic or property damage caused by misuse and/or malfunctions of this product and its peripherals, unless such liability is acknowledged by law.

-

Page 3: Table Of Contents

Key Notations in This Manual ...4 Chapter 1: Getting Started ... 5 Preparing to Use the Calculator ...5 Resetting the Calculator In Case of Diffi culty ...5 Calculator and Display Layout ...6 The SET UP Menu ...8 Operating Modes ...10 Chapter 2: General Information ... -

Page 4: Introduction

Introduction Thank you for purchasing a SHARP Business/Financial Calcula- tor. After reading this manual, store it in a convenient location for future reference. • Display of examples shown in this manual may not look ex- actly the same as what is seen on the product. For instance, screen examples will show only the symbols necessary for explanation of each particular calculation. -

Page 5: Key Notations In This Manual

Key Notations in This Manual Key operations are described in this manual as follows: To specify log To specify 1 To specify Σxy To specify CLR-D : . ? ... To specify ENT To specify Z To specify DATA : J ... Functions that are printed in orange above the key require . -

Page 6: Chapter 1 Getting Started

The RESET operation will erase all data stored in memory and restore the calculator’s default setting. In rare cases, all the keys may cease to function if the calculator is subjected to strong electrical noise or heavy shock during use. -

Page 7: Calculator And Display Layout

12-digit 7-segment character line (10-digit mantissa and 2-digit exponent). Power ON/OFF and Clear key: Turns the calculator ON. This key also clears the display. To turn off the calculator, press . , then c. Key operation keys: . -

Page 8: Display Layout

Display layout Equation/ variable name display • During actual use, not all symbols are displayed at the same time. • Only the symbols required for the operation being explained are shown in the screen examples of this manual. : Appears when the entire equation cannot be displayed. Press g / y to see the remaining (hidden) part. -

Page 9: The Set Up Menu

0 and 9. Entering 0 will set a 10-digit display. • If a fl oating point number does not fi t in the specifi ed range, the calculator will display the result in scientifi c notation (expo- nential notation). See the next section for details. - Page 10 Selecting the fl oating point number system in scien- tifi c notation The calculator has two settings for displaying a fl oating point number: FLO_A (FLOAT A) and FLO_B (FLOAT B). In each display set- ting, a number is automatically displayed in scientifi c notation outside the following preset ranges: •...

-

Page 11: Operating Modes

Selecting the date format • US (Month-Day-Year): ~ 3 0 (default setting) • EU (Day-Month-Year): ~ 3 1 Operating Modes This calculator has two operating modes, which can be selected using the MODE key. Selecting a mode 1. Press m . -

Page 12: Chapter 2: General Information

5 S 3 8 4 S –3 (5 × 10 ) ÷ (4 × 10 , 3 = Clearing the Entry and Memories The following methods of clearing the calculator (restoring de- fault settings) are available: Key operation ( 5 , ) Result 14000... -

Page 13: Delete Key

TVM variables, listed fi nancial variables, cash fl ow data, or STAT, refer to the relevant section. • If you turn off the calculator (by pressing . c or by let- ting it turn itself off automatically), it will resume wherever you left off when you turn it on again. -

Page 14: Editing And Correcting An Entry

fl ow data, and STAT), press 0 0 or 0 = . • To RESET the calculator, press 1 0 or 1 = . The RESET operation erases all data stored in memory, and restore the calculator’s default settings. -

Page 15: Memory Calculations

For details, see page 76. Memory Calculations This calculator has 11 temporary memories (A-H and X-Z), one independent memory (M) and one last answer memory (ANS). It also has various variables for use in fi nancial calculations and statistical calculations. - Page 16 N, I/Y, PV, PMT, FV All fi nancial variables, except for TVM variables x , sx , σ x , n , Σ x , Σ x Temporary memories (A-H, X-Z) Press g and the variable key to store a value in memory. Press f and the variable key to recall a value from the memory.

- Page 17 of calculation (for example, both bond calculations and the TVM solver use the variable I/Y), you can retrieve the value simply by switching calculation types and bringing up the variable. Statistical variables Statistical data is not entered into variables. Statistical variables are the results of the calculation of statistical data.

-

Page 18: Chapter 3 Financial Functions

Chapter 3 Financial Functions General Information Financial calculations The following fi nancial functions are available. Use NORMAL mode to perform fi nancial calculations. TVM (Time Value of Money) solver: Analyze equal and regular cash fl ows. These include calculations for mortgages, loans, leases, savings, annuities and contracts or investments with regular payments. - Page 19 Variables used in fi nancial calculations Financial calculations use multiple variables. By entering known values into variables, you can obtain unknown values. Variables used in fi nancial calculations are categorized into the following two types, depending on the entry method. TVM variables: Variables that are used in the TVM solver.

- Page 20 Basic variable operations TVM variables (N, I/Y, PV, PMT, FV) A. Entering a value Enter a value and then press the corresponding TVM vari- able key. Note: You can also enter values into variables using arithmetic operations. Ex. 100 x 12 u B.

- Page 21 Variable can be used as a known, but not as an unknown. Variable can be used as an unknown, but not as a known. Variable can be used as either a known or an unknown. Unknown variable, but the calculator calculates the value automatically.

-

Page 22: Compound Interest

Compound interest This calculator assumes interest is compounded periodically in fi nancial calculations (compound interest). Compound inter- est accumulates at a predefi ned rate on a periodic basis. For example, money deposited in a passbook saving account at a bank accumulates a certain amount of interest each month, increasing the account balance. -

Page 23: Tvm (Time Value Of Money) Solver

Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. • All the TVM solver variables retain their previously entered values. If you wish to clear all the data, press . b. - Page 24 . < to enter N (total number of payments). Enter the number of years and press . <. The calculator automatically calculates the total number of payments. • By pressing f / you can use the result of the pre- vious normal calculation stored in ANS memory as a TVM variable.

- Page 25 Procedure Set all the variables to default values. Make sure ordinary annuity is set (BGN is not displayed). Set the number of pay- ments per year to 12. The number of compounding periods per year is automatically set to the same value as P/Y.

- Page 26 Calculating basic loan payments Calculate the quarterly payment for a $56,000 mortgage loan at 6.5% compounded quarterly during its 20-year amortization period. PV = $56,000 PMT = ? Procedure Set all the variables to default values. Make sure ordinary annuity is set (BGN is not displayed). Set the number of pay- ments per year to 4.

- Page 27 Calculating future value You will pay $200 at the end of each month for the next three years into a savings plan that earns 6.5% compounded quar- terly. What amount will you have at the end of period if you continue with the plan? PV = 0 PMT = –$200...

- Page 28 Calculating present value You open an account that earns 5% compounded annually. If you wish to have $10,000 twenty years from now, what amount of money should you deposit now? PV = ? Procedure Set all the variables to default values. Make sure ordinary annuity is set (BGN is not displayed).

-

Page 29: Ordinary Annuity

Specifying payments due ( This calculator can select ordinary annuity or annuity due de- pending on the regular cash fl ow (payment) conditions. Ordinary annuity (END): This is the default setting for fi nancial calculations. BGN is not displayed. A regular cash fl ow (payment) is received at end of each payment period. -

Page 30: Annuity Due

Procedure Enter the total number of payments. Enter the future value. Set the present value to zero. Enter the annual inter- est rate. Calculate payment. Answer: The monthly investment should be $16,245.70. Annuity due Your company wishes to obtain a computer system with a value of $2,995. - Page 31 Procedure The number of compounding periods per year is automatically set to 12. Press s to exit the P/Y and C/Y settings. Enter the total number of payments. Enter the future value. Enter payment. Enter the present value. 2995 v Calculate the annual interest rate.

- Page 32 Procedure Set all the variables to default values. Set to annuity due (BGN is displayed). Set the number of pay- ments per year to 12. The number of compounding periods per year is automatically set to 12. Press s to exit the P/Y and C/Y settings. Enter the total number of payments.

- Page 33 Procedure Set all the variables to default values. Make sure ordinary annuity is set (BGN is not displayed). Set the number of pay- ments per year to 12. The number of compounding periods per year is automatically set to 12. Press s to exit the P/Y and C/Y settings.

-

Page 34: Amortization Calculations

Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. • All the TVM solver variables retain their previously entered values. If you wish to clear all the data, press . b. - Page 35 8. Press i to calculate the next period of the amortization schedule. 9. Repeat steps 5 to 7 above. • If you press @ during “AMRT P1” and “AMRT P2” entry, the values for the next period of payment will be automatically calculated and displayed.

- Page 36 Procedure Display the principal paid. Display the interest paid. 3. Calculate the amortization schedule for the second year. Procedure Change amortization schedule to the second year and enter 6 (Janu- ary) for the starting payment. Enter 17 (December) for the ending payment. Display the remaining balance.

- Page 37 Calculating payments, interest, and loan bal- ance after a specifi ed payment You have taken out a 30-year loan for $500,000, with an annual interest rate of 8.5%. If, after the 48th period, you want a balloon payment due, what amount of monthly payment must you make with monthly compounding and how much will the balloon pay- ment be? Procedure...

-

Page 38: Entering Cash Flow Data

fl ow data. • Press , to enter a negative cash fl ow (outfl ow). • Make sure the calculator is in NORMAL mode. It is not pos- sible to enter cash fl ow data when listed fi nancial variables are shown on the display. - Page 39 Procedure Bring up the initial dis- play in NORMAL mode. Enter cash fl ow data. If there is cash fl ow data stored, press > . b to clear it. The format of the data set (cash fl ow and frequency values) number, which is initially set to “0.00,”...

- Page 40 • Press . z or . i to jump to the fi rst or the last data item, respectively. • Each data item is displayed in the form CF Dn= (cash fl ow value) or CF Nn= (frequency), where n indicates the data set number.

-

Page 41: Basic Operations

• The BGN/END setting is not available for discounted cash fl ow analysis. NPV and IRR The calculator solves the following cash fl ow values: Net present value (NPV): The total present value of all cash fl ows, including cash paid out (outfl... - Page 42 2. Enter cash fl ow data. • Refer to page 37 for instructions on entering cash fl ow data. 3. Press . < to begin discounted cash fl ow analysis. • If a previously entered cash fl ow value is displayed, press s to exit and then press .

- Page 43 Procedure Enter cash fl ow data. Return to the initial dis- play in NORMAL mode. If there is cash fl ow data stored, press > . b to clear it. 2. Calculate IRR. Procedure Select discounted cash fl ow analysis, and set all the variables to default values.

- Page 44 –$50,000 –$50,000 –$50,000 –$100,000 1. Enter the cash fl ow data. Procedure Bring up the initial dis- play in NORMAL mode. Enter cash fl ow data. Return to the initial dis- play in NORMAL mode. If there is cash fl ow data stored, press > . b to clear it.

-

Page 45: Bond Calculations

Bond Calculations Using bond calculations, you can obtain bond prices, yields to maturity, and accrued interest. Variables used in bond calculations Variable COUPON (PMT) Annual coupon rate (%) REDEMPT (FV) Redemption value M-D-Y 1 Settlement date (date of bond pur- chase) M-D-Y 2 Redemption date... - Page 46 Basic operations Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. 2. Select bond calculations by pressing # . • To end bond calculations, press s .

- Page 47 Calculating bond price and accrued interest A $100, 20-year, 6.5% coupon bond is issued to mature on August 15, 2023. It was sold on November 3, 2006 to yield the purchaser 7.2% compounded semiannually until maturity. At what price did the bond sell? Also calculate the accrued coupon interest.

-

Page 48: Entering Dates

Procedure Change the bond price to $92.50. Calculate the yield. Answer: The yield will be 7.28%. Entering dates Refer to the following notes for date entry. • Enter using US date format (MM-DD-YYYY) or EU date for- mat (DD-MM-YYYY). Refer to the previous example and the following explanation. -

Page 49: Depreciation Calculations

~ 2 1 ~ 2 2 Basic operations Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. Description Description SL (Straight-line method) SYD (Sum-of-the-years’ digits method) - Page 50 2. Select the depreciation method (see page 48). 3. Select depreciation calculations by pressing O . • When using the declining balance method, DB (I/Y) ap- pears. Enter the number and press Q . • To end depreciation calculations, press s . If you press s during entry, any entered values will be cleared.

- Page 51 Calculating straight-line depreciation In April, your company begins depreciation of a commercial building with a 30-year life and no salvage value. The building costs $1,500,000. Calculate the depreciation amount, remaining book value and remaining depreciable value for the third year using the straight-line depreciation method.

-

Page 52: Conversion Between Apr And Eff

EFF refl ects your actual annual rate of return. Basic operations 1. Press s to clear the display. Make sure the calculator is in NORMAL mode. 2. Enter the calculation data in the following format: •... -

Page 53: Day And Date Calculations

5. Move to the variable you wish to calculate, using the z and i keys, and press @ to calculate. • If the calculator is set to 360-day calendar mode (360 is displayed), it is not possible to obtain either the fi rst or last dates, only the number of days. - Page 54 Calculating number of days Calculate the number of days between December 25, 2008 and August 10, 2009 (using US date format and the actual calen- dar). Procedure Bring up the initial dis- play in NORMAL mode. Select day and date calculations, and set all the variables to default values.

-

Page 55: Percent Change/Compound Interest Calculations

Number of compounding periods Basic operations Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. 2. Select percent change/ com- pound interest calculations by pressing . B. - Page 56 Calculating percent change Sales in a company were $75,000 during the fi rst year of opera- tion. The second year’s sales were $116,000. What percentage greater were the second year’s sales than fi rst year’s sales? In this calculation, the number of compound periods is set to 1 (default).

-

Page 57: Cost/Sell/Margin/Markup Calculations

Markup (%) is calculated based on cost. Basic operations Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. 2. Select cost/sell/margin/ markup calculations by pressing I . • To end cost/sell/margin/mark- up calculations, press s . - Page 58 3. Enter the values of any two known variables as follows: Unknown variable COST SELL MARGIN MARK UP Because only either MARGIN or MARK UP is used in any cost/sell/margin/markup calculation, the unused variable is given a value of “----------”. Initially, MARK UP is set to “----------”.

-

Page 59: Breakeven Calculations

Quantity Basic operations Refer to page 19 for basic variable operations. 1. Press s to clear the display. • Make sure the calculator is in NORMAL mode. 2. Select breakeven calculations by pressing $ . • To end breakeven calcula- tions, press s . - Page 60 Procedure Select breakeven calculations, and set all the variables to default values. Enter fi xed cost. Enter variable cost per unit. Enter unit price. Leave profi t as is. Calculate quantity. Answer: The breakeven point of this product is 339.37 units. Key operation $ .

-

Page 61: Chapter 4: Scientifi C Functions

Chapter 4 Scientifi c Functions This calculator has a variety of functions. Press m 0 to select NORMAL mode and perform scientifi c calculations. • For basic calculations, see page 11. • When a listed fi nancial variable is displayed, you can enter the result of a scientifi... -

Page 62: Scientifi C Calculations

Scientifi c Calculations Example sin 60 [°] = π cos — [rad] = –1 1 [g] = –1 1 [°] = • The range of the results of inverse trigonometric functions θ = sin GRAD Example s ( . ] c 1.5 (cosh 1.5 + . -

Page 63: Random Functions

400 - 30 . % 400 – (400 30%) = Random Functions This calculator has four kinds of random functions (the 2nd func- tion of the - key). Random numbers A pseudo-random number, consisting of three signifi cant digits from zero up to 0.999, can be generated by pressing . | 0 = . -

Page 64: Modify Function

Random integer An integer between 0 and 99 can be generated randomly by pressing . | 3 = . To generate further random numbers in succession, press = for each number. Press s to exit. Example Pick a random number between zero and 9.99. -

Page 65: Chapter 5: Statistical Functions

Chapter 5 Statistical Functions Statistical calculations can be performed in STAT mode. The symbol will be visible if you are in STAT mode. There are seven sub-modes within STAT mode, corresponding to each of the functions below: Key operation m 1 0 SD: Single-variable statistics m 1 1 LINE: Linear regression... - Page 66 • You can enter a total of up to 100 statistical and/or cash fl ow data items. For single-variable data, a data set without a frequency is counted as one data item, and a data set with an assigned frequency is counted as two data items. For two- variable data, a data set without a frequency is counted as two data items, while a data set with an assigned frequency is counted as three data items.

- Page 67 Confi rming and editing data • Use z / i to display a data item from a previously entered data set. FRQ1= • Press . z or . i to jump to the fi rst or last data item, respectively. •...

-

Page 68: Statistical Calculations And Variables

Editing statistical data Change the previously entered data from page 65 as follows: Procedure Display the statistical data. Change the “40, 2” data set to “45, 3”. Delete “50”. Add “60”. Statistical Calculations and Variables The following results can be obtained for each statistical calcula- tion (refer to the table below): Single-variable statistical calculations Section... - Page 69 The estimate of y for a given x (estimate y ´) and the estimate of x for a given y (estimate x ´) can also be found. Because the calculator converts each formula into a linear regression before actual calculation takes place, it obtains all statistics — except coeffi...

- Page 70 Single-variable statistical calculation Example DATA σ x = Σ x = Σ x sx = (95 – x ) — × 10 + 50 = Key operation m 1 0 . 95 J 80 J 75 > 3 J 50 J .

- Page 71 Linear regression calculation Example m 1 1 DATA 2 > 5 J 12 > 24 J 21 > 40 > 3 J 15 > 25 J sx = sy = x = 3 y´ = ? 3 . ? y = 46 x´...

- Page 72 Quadratic regression calculation Example m 1 2 DATA 12 > 41 J 8 > 13 J 5 > 2 J 23 > 200 J 15 > 71 J x = 10 y´ = ? 10 . ? y = 22 x´...

-

Page 73: Appendix

Appendix Financial Calculation Formulas TVM solver PMT, PV, FV, N Error If PMT = 0 then If N = 1 then If PMT ≠ 0 or N ≠ 1 then fi nd i using the fol- lowing equations: Error i≤ –1 Amortization calculations Calculations (for PV, PMT, and i, see the TVM solver) - Page 74 Bond calculations In its bond calculations, this calculator conforms to rules set up by the book titled Standard Securities Calculation Methods, by Jan Mayle, Securities Industry Association, 1993. Bond calculation is based on the following rules: 1. Whenever the redemption date happens to be the last day of a month, coupons are also paid on the last days of months.

- Page 75 ¬ + 1) –1) 100 Error ≤ –100 Day and date calculations In day and date calculations, this calculator conforms to rules set up in the book titled Stan- dard Securities Calculation Methods, by Jan Mayle, Securities Industry Association, 1993.

-

Page 76: Statistical Calculation Formulas

30/360 1. Adjust D1 and D2 according to the fol- lowing rules: (1) If D2 and D1 are both the last day of February, change D2 to 30. (2) If D1 is the last day of February, change D1 to 30. (3) If D2 is 31 and D1 is 30 or 31, change D2 to 30. -

Page 77: Errors And Calculation Ranges

Errors and Calculation Ranges Errors An error will occur if an operation exceeds the calculation rang- es, or if a mathematically illegal operation is attempted. When an error occurs, pressing g or y automatically moves the cursor back to the place in the equation where the error oc- curred. - Page 78 Equation too long (Error 4): • The equation exceeded its maximum input buffer (160 charac- ters). An equation must be shorter than 160 characters. No solution (Error 5): • The iteration limit was exceeded while calculating one of the following values in an overly complex problem: •...

-

Page 79: Calculation Ranges

Calculation ranges of functions • Within the ranges specifi ed, this calculator is accurate to within ±1 of the least signifi cant digit of the mantissa. However, a calculation error increases in continuous calculations due to accumulation of each calculation error. (This is the same for fi nancial calculations, scientifi... - Page 80 Function • y > 0: –10 • y = 0: 0 < x < 10 • y < 0: x = 2n – 1 –10 10 x –10 sinh x , cosh x , | x | ≤ 230.2585092 tanh x –1 | x | <...

-

Page 81: Battery Replacement

• Keep battery out of the reach of children. • Exhausted battery that is left in the calculator may leak and damage the unit. • Explosion risk may be caused by incorrect handling. -

Page 82: Priority Levels In Calculations

3. Remove the used battery using a ball-point pen or similar object. Do not use a mechani- cal pencil or any sharp or pointed object to remove the battery. (see fi g. 2) 4. Install a new battery into the battery housing with the positive side (+) facing up. -

Page 83: Specifi Cations

Operating temperature: 0°C – 40°C (32°F – 104°F) External dimensions: Weight: Accessories: For more information about business/ fi nancial calculators Visit us on the Internet at: http://sharp-world.com/calculator/ Financial calculations General arithmetic calculations Scientifi c calculations Statistical calculations D.A.L. (Direct Algebraic Logic) Mantissas of up to 14 digits 24 calculations, 10 numeric values 3.0 V …... -

Page 84: Index

Bond calculations, 17, 18, 44–47, 73 Breakeven calculations, 17, 58, 59, 75 (symbol), 8, 20 Calculation ranges, 78, 79 Calculator layout, 6 Calendar range, 44, 47, 52 Cash flow data, 12, 37–40, 76 Cash flow diagrams, 21 Chain calculations, 60 COMP (symbol), 7, 20 Compound interest, 21, 54–56, 75... - Page 85 RATE (I/Y), 18, 40, 72 RBV, 48, 74 RDV, 48, 74 REDEMPT (FV), 18, 44, 73, 76 RESET switch, 5, 12, 81 Resetting the calculator, 5 SALVAGE (FV), 18, 48, 74 SCI, 7, 8 Scientific calculations, 60–63 Scientific notation, 8, 9, 11, 63...

- Page 86 MEMO...

- Page 87 For USA only: This product contains a CR Coin Lithium Battery which contains Perchlorate Material – special handling may apply, California residents, See www.dtsc.ca.gov/hazardouswaste/perchlorate/...

- Page 88 PRINTED IN CHINA / IMPRIMÉ EN CHINE / IMPRESO EN CHINA 06GGK (TINSE1258EHZZ)