Advertisement

Quick Links

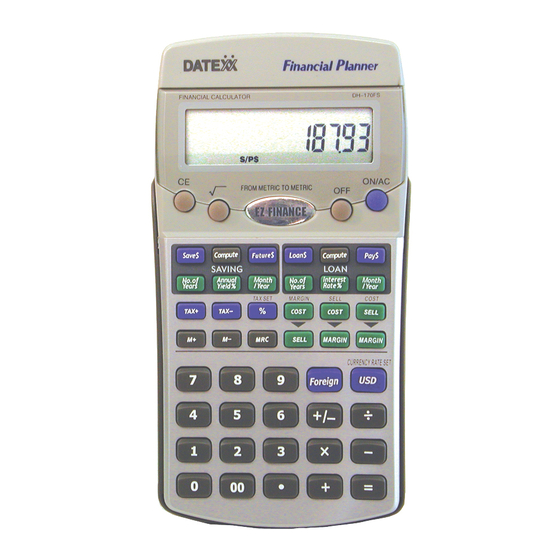

Financial Planner

Model DH-170FS

Operation Manual

Your Financial Planner from

Datexx® is designed to be reliable

and easy to use.

This manual will provide clear

instructions for all product

functions.

An Affordable, 12-Digit Multi-function

Calculator with Built-in Software

Components.

Features

Calculate the Time and Value of Money

(Savings, Automobile and Mortgage Loans).

Interest Calculations

Business Profit analysis (cost, sell & margin)

Currency conversions

Tax Calculations

Savings Calculations

Built-in 3-key Memory Functions

Auto Power-Off -- Turns Unit off After

5 Minutes Idle

Slip Cover -- Slips the Unit Out of the "Base",

Reverse it, and Slide it Back in the Base to Store.

Integrated Flip-Down Stand, for Easy Viewing

Adjustment

Getting Started

Note: Your Datexx Calculator is powered

with a long-life, Lithium battery to assure

uninterrupted service.

(See "Battery Replacement" below for

change-out procedure.)

Power On and Off

ON/AC] Pressing this key and holding it

[

a second turns the calculator on. This key

is also used to clear all calculations, which

is accomplished with a tap.

[OFF] Turns the calculator off. The unit also

has an auto power-off feature which turns

the unit off after 5 minutes of non-use.

[CE] Tapping this key clears only the last

entry without clearing the problem.

Battery Replacement

1. Slide the unit out of its case and turn

the unit over,face down.

2. Use a small head

screwdriver to loosen

two screws on battery

compartment cover

and remove the cover

(see diagram).

3. Use a small head

screwdriver to push up

old battery.

(see diagram)

4. Replace the lithium

battery (CR-2025),

making sure the positive

(+) side is up.

5. Replace the cover

and screws.

Note: The Lithium battery in this calculator

should be replaced approximately every 2 years.

Calculating the Time Value

of Money

Savings calculations

Number of years

Monthly installment

Save $

Annual yield

Calculate

Annual Yield

Compute

%

Month

Number of

Future value

Future $

/Year

compound

periods a year

How much money will I have if I save $150

a month at 4% for the next 10 years?

Save $150

150

[Save $]

a month

For 10 years

10

[No. of Years]

At 4%

[Annual Yield %]

4

interest rate

Making 12

payments

[Month/Year]

12

a year

[Compute] [Future$]

Press--

$22, 161.10

Loan calculations

Mortgage amount

Number of years

Loan $

Interest rate

Calculate

Interest Rate

Compute

%

Month

Number of

Monthly payment

Pay $

/Year

compound

periods a year

Calculating an automobile loan

You have your eye on a new car.

The cost of the car is $22,000, and

your down payment will be $5,000.

You will be financing $17,000 at 8%.

What will your payments be?

Automotive

$17,000

[Loan $]

Loan

Number of

[No. of Years]

5

years to pay

[Interest Rate%]

Interest Rate

8%

12 payments

[Month/Year]

12

a year

[Compute] [Pay$]

$342.42

Press--

Loan Calculations

Calculating a mortgage

You are buying a $120,000 Town House.

Your down payment is 10% ($12,000), and you

will be financing $108,000 at 8% for 30 years.

What is your payment?

Home Loan of

$108,000

[Loan $]

Number of years

to pay

30

[No. of Years]

Interest Rate

8%

[Interest Rate %]

12 payments

a year

12

[Month/Year]

[Compute] [Pay$]

Press--

A word about mortgage payments (PITI)

A mortgage payment will include the mortgage

payment principal and interest, in this case

$787.22. It will also include the monthly real

estate taxes and insurance payment (Divide

the annual rate by 12 to get the monthly rate).

For Example:

Annual taxes at $2,400, and annual insurance

at $600 = $200 monthly tax payment + a $50

monthly insurance payment. Adding these to

the total payment of $787.22 give us a total

monthly payment of $1,037.22 (This is called

Principal + Interest + Taxes + Insurance or PITI.)

How to compute the mortgage

payment you can afford

Industry guidelines indicate that a consumer

should spend about 28% of his monthly

income on housing. If your combined

family monthly income is $6,000, you can

afford a mortgage payment (PITI) of $1,680.

(Other payments. like credit card and car

payments, installment loans, etc., should not

exceed 36% of your gross family monthly income.)

$6,000

[X]

28

[%]

$1,680

How much loan can I get with

a PITI of $1,680

Enter Payment

$1,680

[Pay $]

Number of years

to pay

30

[No. of Years]

Interest Rate

8%

[Interest Rate%]

12 payments

[Month/Year]

a year

12

Press--

[Compute] [Loan $]

$230,482.65

$787.22

Advertisement

Summary of Contents for Datexx Financial Planner DH-170FS

-

Page 1: Getting Started

Loan Calculations Getting Started of Money Calculating a mortgage Financial Planner Note: Your Datexx Calculator is powered You are buying a $120,000 Town House. Model DH-170FS Savings calculations with a long-life, Lithium battery to assure Your down payment is 10% ($12,000), and you uninterrupted service. -

Page 2: Simple Arithmetic Calculations

2. Enter the USD value (0.9822). Calculating percentages is easy with your such as dealer cost. Datexx DH-170FS. Your credit card charge is $138.00. 3. Press the [USD] key setting the value. (Note: Pay special attention to the keys...